Milan, 13 March 2025 – Under the buyback program of treasury shares referred to Art. 5 of the Commission Delegated Regulation (EU) no. 596/2014 (the “MAR”), announced to the market on 4 March 2025 and launched on 5 March 2025 for a maximum number of 7,700,000 ordinary shares (the “Program”) dedicated to the “2021-2023 Long-term Incentive Plan”, the “2022-2024 Long-term Incentive Plan”, the “2023-2025 Long-term Incentive Plan” (limited to a stock of shares to be granted to a "good leaver" beneficiary, pursuant to the Plan Regulation), the “Restricted Stock and Matching Shares Plan” and the Second Cycle (2024) of the "Employees Share Ownership Plan 2023-2025 dedicated to all employees” (jointly, the “Share Incentive Plans”), MAIRE S.p.A. (the “Company” or “MAIRE”) announces – according to the provision and for the purpose of Article 2 paragraph 3 of the Commission Delegated Regulation (EU) 1052/2016 of 8 March 2016 (the “1052 EU Regulation”) – to have acquired on the Euronext Milan Market (EXM) organized and managed by Borsa Italiana S.p.A., in the period from 7 March 2025 to 13 March 2025 included, total no. 1,066,074 of treasury shares (corresponding to 0.324% of the total number of ordinary shares), at a weighted average price of Euro 8.425 for a total counter-value of Euro 8,981,970.52.

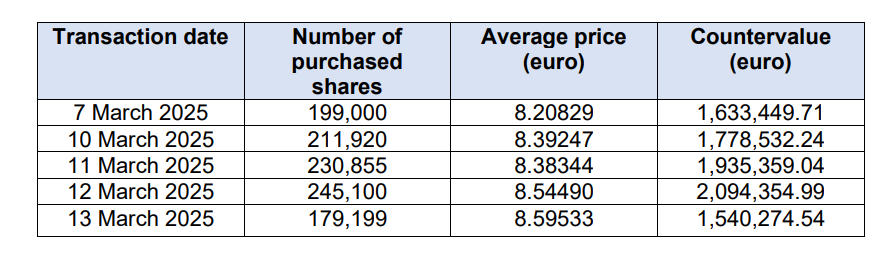

On the basis of information provided by Intesa Sanpaolo S.p.A., the authorized intermediary in charge of carrying out the buyback mentioned in the present press release, here below is a summary of the daily operations, in aggregate form:

In accordance with the provisions of Article 2 paragraph 3 of the 1052 UE Regulation, attached to this press release, information of the daily buying-in operations carried out in the above-mentioned period is indicated in detail.

This information is also published on the Company’s website, www.groupmaire.com (Section “Investors” – “Press Release” – “Buy Back”) for a five-year period.

In the light of the purchases made, on today’s date the treasury shares held by the Company amount to no. 1,573,534.