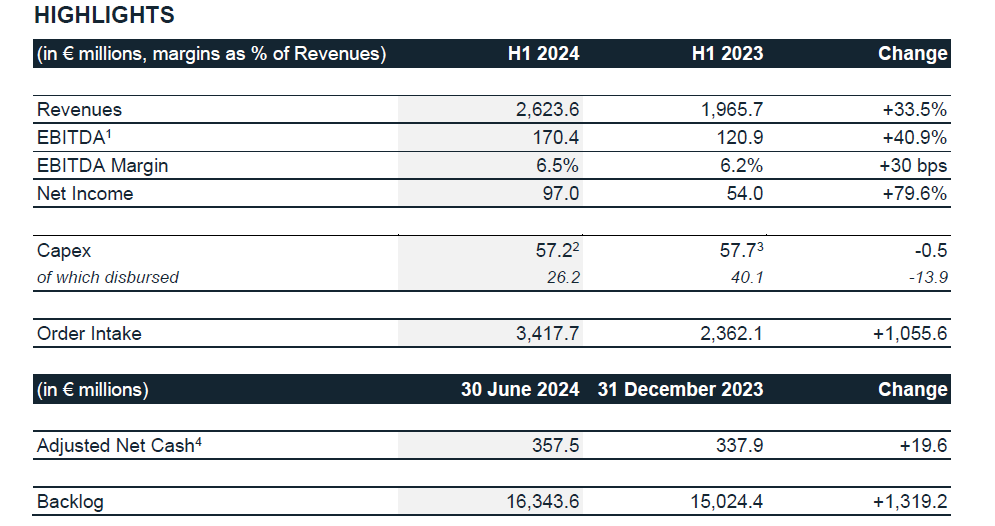

- Robust semester with double-digit growth of the main economic metrics

- Revenues in excess of €2.6 billion (+33.5%)

‒ EBITDA of €170.4 million (+40.9%), margin increased from 6.2% to 6.5%

‒ Net income of €97.0 million (+79.6%), margin increased from 2.7% to 3.7%

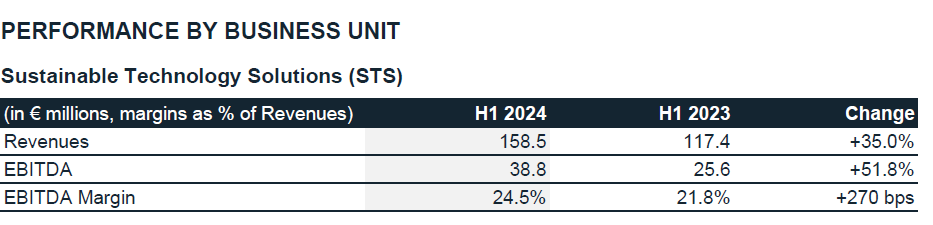

- Remarkable performance of Sustainable Technology Solutions, generating revenues of €158.5 million (+35.0%) and EBITDA of €38.8 million (+51.8%)

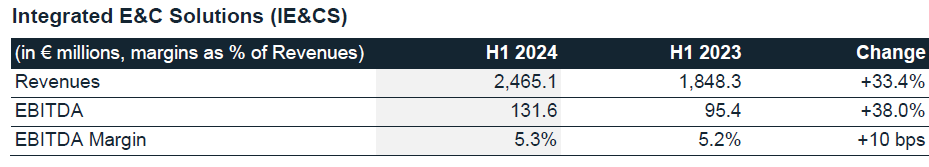

- Consistent growth of Integrated E&C Solutions, generating revenues of €2.5 billion (+33.4%) and EBITDA of €131.6 million (+38.0%), also thanks to the timely progress of Hail and Ghasha

- Adjusted Net Cash of €357.5 million, up €19.6 million compared to the end of 2023 net of dividends of €63.5 million and a share buy-back program of €47.3 million

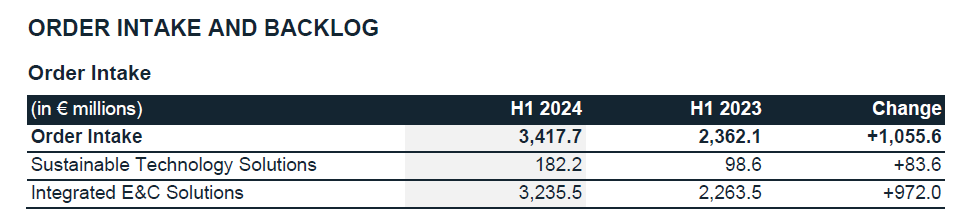

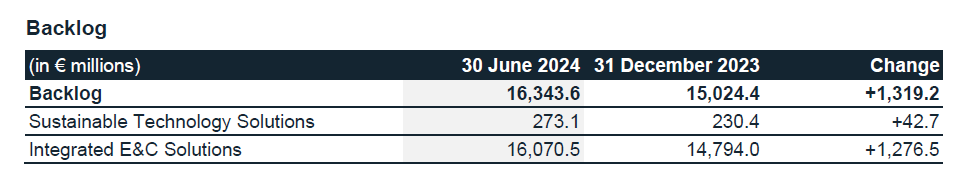

- Order intake at €3.4 billion, contributing to a solid backlog of €16.3 billion, up €1.3 billion compared to the end of 2023

- Group headcount up by more than 500 people compared to the end of 2023, exceeding 8,500 people at the end of June 2024

- Successfully acquired HyDEP and GasConTec expanding NEXTCHEM’s technology portfolio, as well as APS Group in July, increasing engineering capacity by adding almost 300 professionals in Poland and Italy

- 2024 Guidance confirmed

Milan, 31 July 2024 – The Board of Directors of MAIRE S.p.A. (“MAIRE” or the “Company”) today reviewed and approved the Half Year Consolidated Financial Report as of 30 June 2024.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented: “We are proud to present today our First Half 2024 results which continue to show a solid double-digit growth in the key indicators and an increase in profitability. Sustainable Technology Solutions is enjoying a strong market demand for its proprietary technologies, enhanced with the acquisitions of HyDEP and GasConTec. At the same time, we keep navigating the current energy investment supercycle by expanding our engineering capacity: our current headcount of more than 8,500 people at the end of June has been further enhanced thanks to the newly acquired APS Group, which will bring onboard a multidisciplinary team of almost 300 professionals. The robust backlog of €16.3 billion euro and the resulting increased visibility on the Group’s future growth testify to the effectiveness of our strategic initiatives.”

Consolidated financial results as of 30 June 2024

Revenues were €2.6 billion, up 33.5%, thanks to the steady progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €170.4 million, up 40.9%, driven by higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.5%, up 30 basis points, also thanks to an increased contribution from technologies and high value-added services.

Amortization, Depreciation, Write-downs, and Provisions were €30.7 million, up €4.5 million due to the marketing of new patents and technological developments, as well as the start into operation of assets for the digitalization of industrial processes.

EBIT was €139.7 million, up 47.4%, with a margin of 5.3%, up 50 basis points.

Net financial income was €2.9 million, compared to €17.4 million of net financial charges, thanks to the positive contribution of derivative instruments and a higher yield on cash deposits.

Pre-tax Income was €142.6 million and the tax provision was €45.7 million. The effective tax rate was 32.0%, slightly up compared with the last periods, mainly due to the various jurisdictions where Group operations have been carried out.

Net Income was €97.0 million, up 79.6%, with a 3.7% margin, up 100 basis points.

Adjusted Net Cash as of 30 June 2024, excluding leasing liabilities (IFRS 16) and other minor items, was €357.5 million, up by €19.6 million versus 31 December 2023. Operating cash generation more than compensated the outflows for capital expenditures of €26.2 million, dividends of €63.5 million, and the share buy-back program of €47.3 million.

Total Capex, which were mainly dedicated to the expansion of the technology portfolio and to digital innovation projects, amounted to €57.2 million, including also the deferred and earn-out components of the acquisition prices of HyDEP, Dragoni Group and GasConTec, as well as for the additional stake in MyReplast.

Consolidated Shareholders’ Equity was €559.2 million, down €20.5 million versus 31 December 2023, as a result of the FY2023 dividend payment, the share buy-back program and the impact of exchange rate fluctuations, partially offset by the profit of the period.

Revenues amounted to €158.5 million, up 35.0%, thanks to the constant growth recorded in technological solutions and services mainly in nitrogen fertilizers, carbon capture and circular fuels.

EBITDA was €38.8 million, up 51.8%, as a result of higher volumes, with a margin of 24.5%, up 270 basis points, also thanks to the product mix.

Revenues amounted to €2.5 billion, up 33.4%, thanks to the progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €131.6 million, up 38.0%, and with a margin of 5.3%, up 10 basis points.

Order Intake in the first half of 2024 was €3.4 billion.

In particular, the Sustainable Technology Solutions business unit led by NEXTCHEM generated new orders for €182.2 million. The main projects awarded in the second quarter to this business unit include:

- a Process Design Package to reduce energy consumption of a urea plant in China with the MP Flash Design proprietary technology;

- the Process Design Package for the hydrogen and CO2 recovery unit of the Hail and Ghasha gas development project;

- licensing of the NX CircularTM gasification technology for DG Fuels’ Sustainable Aviation Fuel (SAF) plant in the USA;

- a Feasibility Study and a Pre-FEED based on NX STAMI Green AmmoniaTM and NX STAMI NitratesTM technologies for FertigHy’s low-carbon fertilizers plant in France;

- new contracts mainly related to the design and supply of proprietary equipment based on fertilizer technology, a feasibility study based on NX CONSER DuettoTM biodegradable monomers technology, and other engineering services.

The Integrated E&C Solutions business unit generated new orders for €3.2 billion. The main projects awarded in the second quarter to this business unit include:

- an Engineering, Procurement and Construction contract awarded by SONATRACH for the implementation of three gas boosting stations and the upgrading of the gathering system, located at the Hassi R’mel gas field in Algeria;

- an Engineering, Procurement and Construction contract to develop an Hydrotreated Vegetable Oil (HVO) complex inside the existing HOLBORN’s refinery in Hamburg, Germany.

For the details on the first quarter 2024 awards, please refer to the corresponding Financial Results press release.

As a result of the order intake of the period, the Group's Backlog at 30 June 2024 amounted to €16.3 billion.

Update on the Hail and Ghasha project

The Hail and Ghasha gas treatment and sulphur recovery project, awarded to Tecnimont in October 2023 for a value of $8.7 billion, is progressing on schedule, which envisages completion in 2028. Engineering activities, mainly focused on the ongoing review of the 3D model, have achieved 23% completion. Procurement has progressed with the placement of all the orders for long lead items, as well as a significant portion of the orders for bulk and other itemized items. Construction activities have also been launched, with the placement of contracts for the implementation of the temporary construction facilities and the early works for the foundations.

Subsequent events after the close of the period

Contribution of KT TECH in NEXTCHEM

On 4 July 2024, MAIRE’s Board of Directors approved the equity contribution of the entire share capital of KT TECH in NEXTCHEM though a share capital increase of NEXTCHEM exclusively reserved to MAIRE. KT TECH, which was established following the demerger of KT – Kinetics Technology, offers technologies, engineering services and proprietary equipment, all activities which are consistent with NEXTCHEM’s proposition, particularly for hydrogen and methanol production as well as sulphur recovery. As a result of the transaction, MAIRE now holds 82.13% of NEXTCHEM’s share capital.

Placement of a €200 million Sustainability-linked Schuldschein Loan

On 16 July 2024, MAIRE announced the placement of a new Sustainability-linked Schuldschein Loan for a total amount of €200 million. The loan is structured in two tranches with maturities of three and five years and pricing is linked to the achievement of the Group’s CO2 emissions reduction targets. The proceeds will be primarily used for the early repayment of existing facilities, including the ESG-Linked Schuldschein Loan issued in December 2019 for an outstanding amount of €55 million, which was reimbursed on 22 July 2024.

Acquisition of APS Group

On 30 July 2024, KT – Kinetics Technology acquired APS Evolution, parent company of APS Designing Energy S.r.l. and KTI Poland S.A., both engineering companies with a solid track record in the conversion of natural resources, including petrochemical and green processes. This acquisition will enable MAIRE to expand its engineering capacity by adding a multidisciplinary team of almost 300 professionals and strengthen its footprint in Eastern Europe. The purchase price is €7.7 million, of which €1.2 million paid at closing, and €6.5 million due in four instalments by 2030.

Contracts awarded after the close of the period

The main contracts awarded in July 2024 include:

- an Engineering Design Study for a green ammonia plant in India awarded to Tecnimont Private Limited, leveraging on NEXTCHEM’s proprietary ArchHy digital tool;

- licensing and process design package awarded to NEXTCHEM’s subsidiary Stamicarbon to improve energy efficiency of a urea plant in China with Advanced MP Flash Design proprietary technology;

- a feasibility study awarded to NEXTCHEM’s subsidiary Conser to optimize production and increase efficiency of an existing maleic anhydride facility in North America based on Conser proprietary technology.

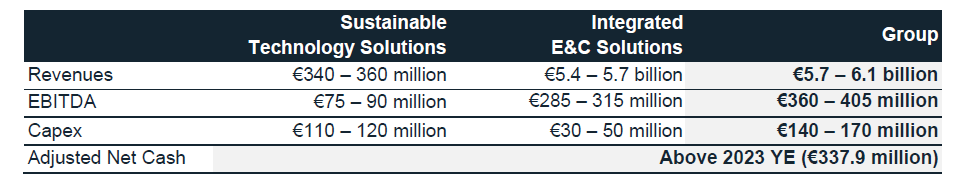

2024 Guidance

In light of the above, particularly the significant backlog, the Company confirms the 2024 guidance disclosed with the 2024-2033 Strategic Plan on 5 March 2024, which includes the following expected KPIs for the current year:

Revenues of both business units are expected to accelerate progressively in the second half of the year. STS will benefit, among other factors, from the expected contribution of the companies which have recently entered NEXTCHEM’s Group business perimeter. IE&CS will be supported by the current backlog, particularly by the expected progress of engineering and procurement activities of the projects awarded last year, including Hail and Ghasha.

Capital expenditures will continue to focus on the technology portfolio expansion to foster the energy transition as well as on digital innovation. Operating cash generation is expected to support an improvement in Adjusted Net Cash compared to the end of 2023.

Update on the organic growth of the Group

MAIRE continues to invest in acquiring new talents to support the Group’s growth. Headcount as of 30 June 2024 exceeded 8,500 employees from about 80 nationalities, up by approximately 500 people during the first half of the year.

Significant Updates on the execution of the Group’s sustainability agenda

During the first half of 2024, MAIRE has progressed in the implementation of its ESG agenda, with several activities carried out in the following areas.

Environment

- Climate: in line with the MET Zero plan, which targets carbon neutrality for Scope 1 and 2 emissions in 2029, the second photovoltaic system to serve a project site was built. With a 300-kilowatt capacity, this system will enable the avoidance of 1,200 tons of CO2 in 2.5 years (equal to 30% of the total emissions of the site camp during its life) at Rhourde El Baguel construction site (Algeria). Additionally, MAIRE signed a Memorandum of Understanding with Sulzer, one of the Group’s main suppliers, aimed at cooperating in the calculation and reduction of the carbon footprint of Sulzer’s products and, consequently, MAIRE’s Scope 3 emissions.

- Water: MAIRE established the MET Water Task Force, a multidisciplinary group focused on the development and implementation of an action plan to optimise water consumption and maximize recovery in the Group’s offices and project sites, as well as to incorporate water consumption criteria in the process design of technologies and projects.

Governance

- Compensation: the weight of ESG objectives in the 2024-2026 Long Term Incentive Plan has been raised to 20% from 10% of the previous plans.

- MAIRE took part in the preparation of the UN Global Compact Network Italy’s position paper “Transformative Governance as a behavioural driver or responsible conduct for an ethical, prosperous and sustainable business”. The paper, which includes MAIRE’s case history, is aimed at providing a picture on how Italian member companies are integrating sustainability within their corporate governance.

Update on the Euro Commercial Paper programme

With reference to the Euro Commercial Paper program launched in 2021 by MAIRE for the issuance of one or more non-convertible notes placed with selected institutional investors for a maximum amount of €150.0 million, it should be noted that as at 30 June 2024 the program is utilized for €126.9 million. The notes will expire in several tranches between July 2024 and June 2025. The weighted average interest rate is 5.205%.

***

Conference Call and Webcast

MAIRE’s top management will present the First Half 2024 Results during a conference call today at 5:30pm CEST.

The live stream of the event can be accessed at the following link:

MAIRE First Half 2024 Results Conference Call (royalcast.com)

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 06 83360400

UK: +44 (0) 33 0551 0200

USA: +1 786 697 3501

The presentation will be available at the start of the event in the “Investors/Financial Results” section of MAIRE’s website (Financial Results | Maire (groupmaire.com)). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).