• Improving economic and financial performance

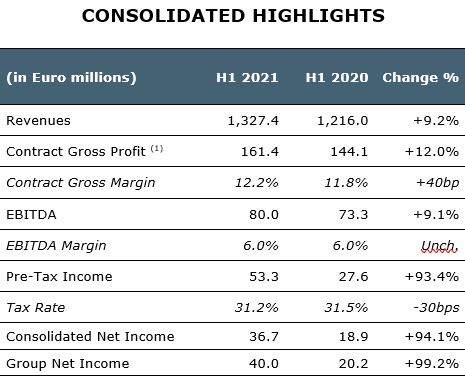

o Revenues: 1,327.4 million (+9.2%)

o EBITDA: €80.0 million (+9.1%)

o Group Net Income: €40.0 million (+99.2%)

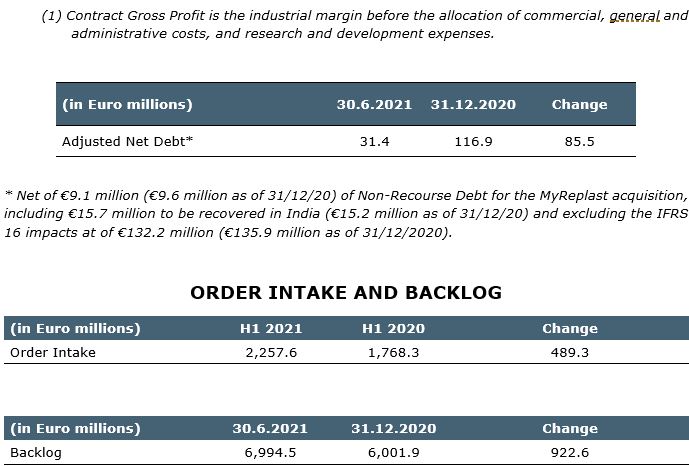

• Adjusted Net Debt of €31.4 million, a decrease of €85.5 million driven by operating cash flows of €164.2 million

• Backlog of €7 billion, 84% in Gas Monetization and Energy Transition

• Order intake: €2.3 billion; YTD: €2.9 billion

• Commercial pipeline of €61.7 billion, 72% in Gas Monetization and Energy Transition

• The Green Energy business growth continues, thanks to new projects and technological partnerships

Milan, 29 July 2021 – Maire Tecnimont S.p.A.’s Board of Directors today has reviewed and approved the Half Year Financial report as of 30 June 2021, which shows a Group Net Income of €40.0 million, up 99,2%.

The changes reported refer to H1 2021 versus H1 2020, unless otherwise stated.

Consolidated Financial Results as of June 30, 2021

Maire Tecnimont Group Revenues were €1,327.4 million up 9.2%. Volumes reflect the non-linear progress of projects in the backlog, depending on the planned schedules for each project, and showing a continuous upward trend due to pick up of the activities of the projects in the backlog and the start of the newly acquired ones.

The on-going advancement of the projects in the backlog and the start of the ones acquired year to date, are going to lead to volumes’ increases over the next few quarters, in line with their scheduled planning, assuming no worsening of the pandemic and its variants.

Contract Gross Profit was €161.4 million, up 12.0%, thanks to the increased revenues and profitability. The latter has increased from 11.8% to 12.2% also thanks to a different revenue mix.

G&A costs were €41.1 million, up 13.6%, also due to the strengthening of the operating structure to support the Green Energy activities as well as the ones in West Africa. The H1 2020 figure benefited from the cost saving initiatives implemented at the outset of the pandemic.

EBITDA was €80.0 million, up 9.1%, thanks to the higher revenues. Margin was 6.0%, unchanged, and in line with the profitability of EPC projects.

Amortization, Depreciation, Write-downs and Provisions were €20.6 million, down 13.4%, as the H1 2020 figure was affected by the temporary impact of the pandemic on some clients’ rating.

EBIT was €59.4 million, up 9.9%, with a profitability improving from 4.1% to 4.5%.

Net Financial Charges were €6.1 million, vs. €22.0 million. Such an improvement was driven by the positive net valuation of derivative contracts for €6.8 million vs. a negative value of €9.8 million which was due to lower stock prices and unfavorable exchange rates due to the pandemic’s impact, leading to a positive change of €16.6 million.

Financial charges, net of the aforementioned effects, are substantially in line, in spite of additional financial charges related the €365 million loan facility 80% backed by SACE's “Garanzia Italia”, signed in July 2020.

Pre-tax Income was €53.3 million. The tax provision was €16.7 million.

The effective Tax Rate was approx. 31.2%, slightly down, but substantially unchanged over the last few quarters, considering that the various jurisdictions where Group operations have been carried out have remained unchanged.

Group Net Income was €40.0 million, up 99.2%, as result of higher revenues and lower Net Financial Charges, as explained above.

Adjusted Net Debt (net of the above-mentioned values in the footnote on page 2) as of June 30, 2021 was €31.4 million, an €85.5 million improvement vs. December 31, 2020 thanks to the operating cashflows generation for €164.2 million, including advances related to the recently acquired projects, and in spite of a €38.1 million dividends payment and the purchase of Treasury Shares for the employees’ incentive plans for €5.5 million.

The Net Financial Position has also been positively impacted by a €41.4 million mark-to-market valuation of the derivative contracts related to Maire Tecnimont’s FX, to commodities price exposure, and to Maire Tecnimont’s share price for what concerns the employees’ incentive plans.

Consolidated Shareholders’ Equity was €472.8 million, up €24.5 million vs. December 31, 2020. This increase was mainly driven by the Net Income of €36.7 million and the positive change of the derivatives’ Cash Flow Hedge reserve of €23.5 million, and by an €8.0 million positive amount related to the translation of the Group companies’ financial statements reported in a foreign currency.

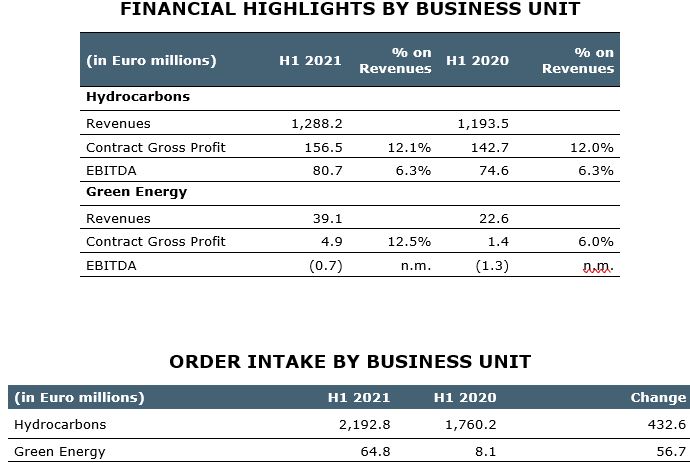

Performance by Business Unit

Hydrocarbons BU

Revenues were €1,288.2 million up 7.9%, for the same reasons commented above. Gross Contract Profit was €156.5 million, with a profitability of 12.1%, in line. EBITDA was €80.7 million, up 8.1%, thanks to higher revenues. Profitability was 6.3%, unchanged, and in line with the profitability of EPC projects.

Green Energy BU

Revenues were €39.1 million, up 73.3%, also thanks to a pickup in NextChem’s activities, driven by a further strengthening of its technological portfolio thanks to several partnership agreements signed with various Italian and international counterparties last year and in the first Semester of 2021. Revenues also increased thanks to a pickup in the activities related to energy efficiency improvements, which had been impacted by the pandemic. Gross Contract Profit was €4.9 million, with a profitability of 12.5%, significantly up vs. 6.0%. EBITDA was -€0.7 million, taking into account higher G&A costs due to the strengthening of NextChem’s organization.

Development of the Green Energy BU

Maire Tecnimont is accelerating its commitment to support the Energy Transition, thanks to new projects and technological partnerships in Italy and abroad.

During H1 2021 several agreements were announced, including:

• a FEED contract as well as a Memorandum of Understanding with Essential Energy USA Corp. for the construction of a new biorefinery in South America for the production of Renewable Diesel;

• an agreement with Agilyx Corporation, a pioneer in the advanced recycling of post-use plastics, to support the worldwide development of advanced chemical recycling facilities;

• a Memorandum of Understanding with Adani Enterprises Ltd. to develop projects focused on producing chemicals, ammonia and hydrogen from renewable feedstocks in India;

• a Memorandum of Understanding with MC TAIF JSC (TAIF) to co-develop a new bio-degradable polymer plant in the Republic of Tatarstan (Russian Federation);

• an agreement with Oserian Development Company for a fertilizer plant powered by renewable energy in Kenya;

• an agreement with Mytilineos for an engineering study related to a green hydrogen plant in Italy;

• a FEED contract with TotalCorbion for a Poly Lactic Acid (PLA) plant in France;

• a FEED contract with TotalEnergies for a Sustainable Aviation Fuel (SAF) plant in France.

Order Intake and Backlog

Thanks to a First Half 2021 order intake of €2,257.6 million, the Group’s Backlog as of June 30, 2021 was €6,994.5 million.

In particular, the main projects awarded to the Group include the following:

• two EPC contracts from SOCAR, as part of the Modernization and Reconstruction of the Heydar Aliyev Oil Refinery in Baku, Azerbaijan for approximately USD160 million;

• an EPC contract with Nigerian National Petroleum Company (NNPC) to carry out rehabilitation works for the Port Harcourt Refinery for approximately USD1.5 billion;

• an EPC contract with Advanced Global Investment Company (AGIC) for the implementation of two polypropylene units in Jubail Industrial City II, Saudi Arabia, for approximately USD500 million;

• an EPCC contract with Indian Oil Corporation Limited (IOCL) for the implementation of a new Para-Xylene (PX) plant in Paradip, Eastern India, for approximately USD450 million.

Subsequent Events

• On July 5, 2021 an EPCC contract was signed with Indian Oil Corporation Limited (IOCL) for the implementation of a new polypropylene plant and related facilities in Barauni, in North-Eastern India, for approximately USD170 million;

• On July 21, several awards were announced for a total amount of approximately USD92 million for licensing, engineering and procurement (EP) services mainly located in North Africa, Eastern Europe, and Southern Asia;

• On July 26, 2021 an EPC contract was signed with Repsol for the realization of a Polypropylene Unit and a linear Polyethylene Unit as part of the Sines Industrial Complex in Portugal, for approximately €430 million.

Thanks to the acquisitions awarded after June 30, 2021, the Year-To-Date Order Intake is worth over €2.9 billion.

Outlook

The "Covid-19" pandemic, with its various variants, continues to influence the markets even if the vaccination campaigns on a global scale, and the measures taken at the institutional level to support a speedy recovery, have led to a progressively greater confidence in a positive evolution of the situation, albeit tempered by the spread of various variants.

All the geographical areas where the Group is present show a higher propensity to increase their investments than in the recent past. This is demonstrated by the significant order intake and by the highest ever commercial pipeline.

The drive to reduce the carbon footprint supports the Group's green activities. The initiatives launched by NextChem are expected to experience a significant evolution over the next few months, thanks to the cooperation and development agreements signed in 2020 and in the first semester of 2021. At the same time, the development and validation of new proprietary technologies continue at a strong pace, as well as the commercial initiatives in various areas, including circular economy, bioplastics/biofuels, CO2 capture and hydrogen. The other activities of the Green Business Unit, which also include initiatives in renewable energy, are also benefiting from a fast-growing commercial pipeline, which should lead to new awards over the next few months in 2021.

Given the recently acquired projects, which will significantly go ahead over the next few weeks, the existing backlog and considering the geographical areas where our operations are taking place, production volumes are expected to rise over the next few quarters with a profitability in line with the first months of 2021, assuming the pandemic and its effect do not worsen in the near future.

***

Webcast Conference Call

The H1 2021 financial results will be presented today at 5:30pm CET during an audio-webcast conference call held by the top management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “H1 2021 Financial Results” banner on the Home Page or through the following url:

https://87399.choruscall.eu/links/mairetecnimont210729.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website

(https://www.mairetecnimont.com/en/investors/results-and-presentations/financial-results). The presentation shall also be made available on the 1info storage mechanism (www.1info.it).

***

Dario Michelangeli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Half Year Financial Report as at 30 June 2021 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This press release, and the “Outlook” section in particular, contains forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

Maire Tecnimont S.p.A.

Maire Tecnimont S.p.A., listed on the Milan Stock Exchange, heads an industrial group which leads the global natural resource conversion market (downstream oil & gas plant engineering, with technological and executive expertise). Its subsidiary NextChem operates in the field of green chemicals and technologies in support of the energy transition. The Maire Tecnimont Group operates in approx. 45 countries, through approx. 50 operative companies and about 9,000 people. For further information: www.mairetecnimont.it www.nextchem.com

Group Media Relations

Carlo Nicolais, Tommaso Verani

+39 02 63137603

mediarelations@mairetecnimont.it

Investor Relations

Riccardo Guglielmetti

Tel +39 02 6313-7823

investor-relations@mairetecnimont.it