- Results in line with the Guidance

- Revenues: €3.3 billion

- EBITDA: €235.6 million

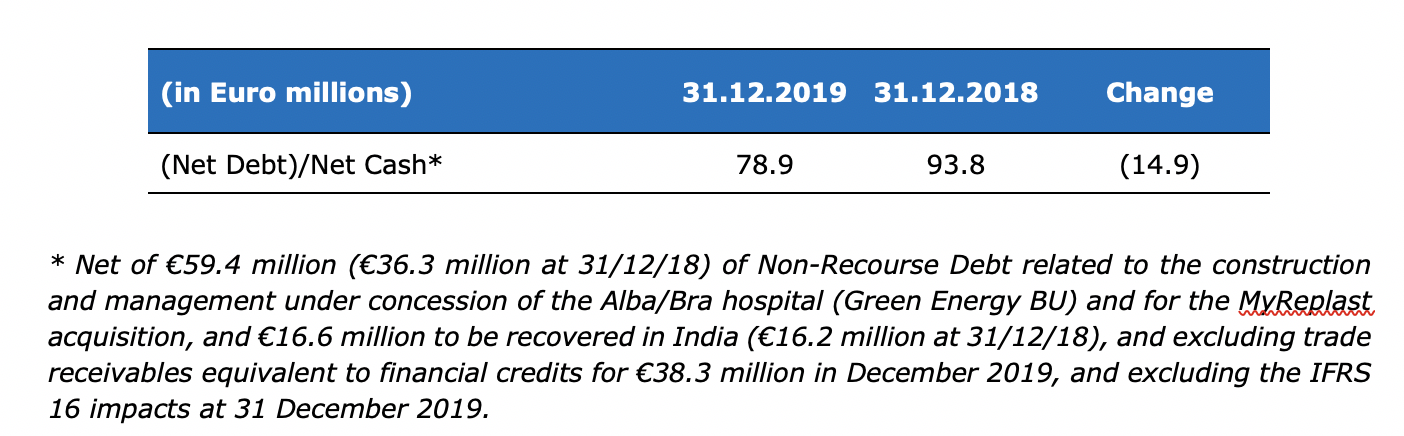

- Adjusted Net Cash: €78.9 million

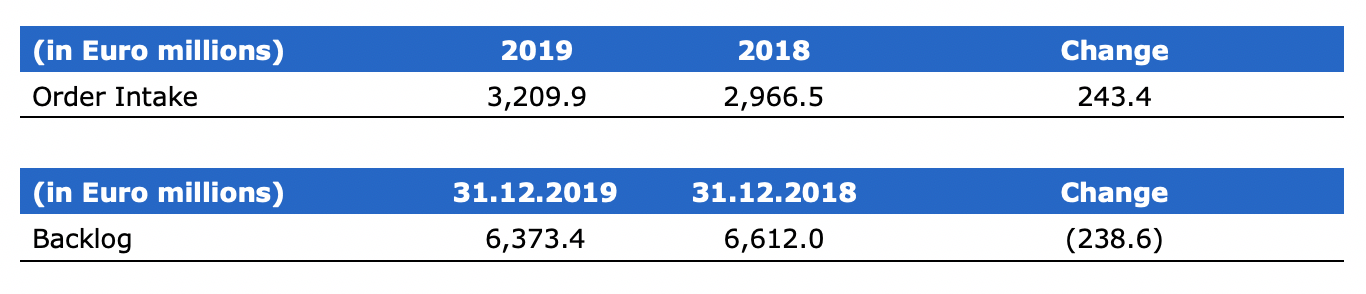

- Order intake: €3.2 billion

- Backlog: €6.4 billion

- Approved the proposal regarding the allocation of profit and distribution of dividends for €38.1 million

Milan, 11 March 2020 – Maire Tecnimont S.p.A.’s Board of Directors today has reviewed and approved the 2019 Draft Statutory and the Group’s Consolidated Financial Statements as at 31 December 2019, which report a Net Income of €30.7 million and a Consolidated Net Income of €114.7 million.

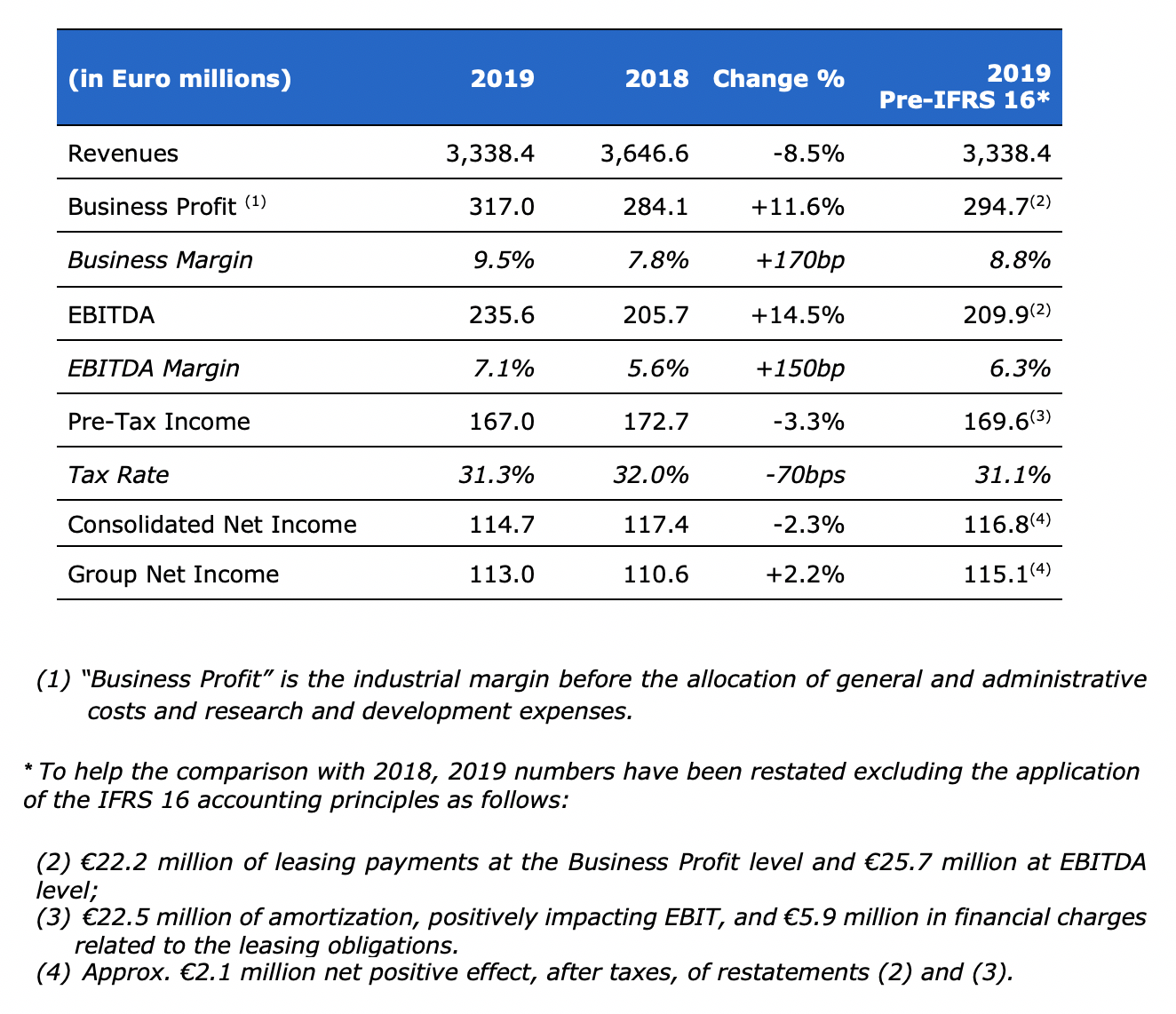

CONSOLIDATED HIGHLIGHTS

ORDER INTAKE AND BACKLOG

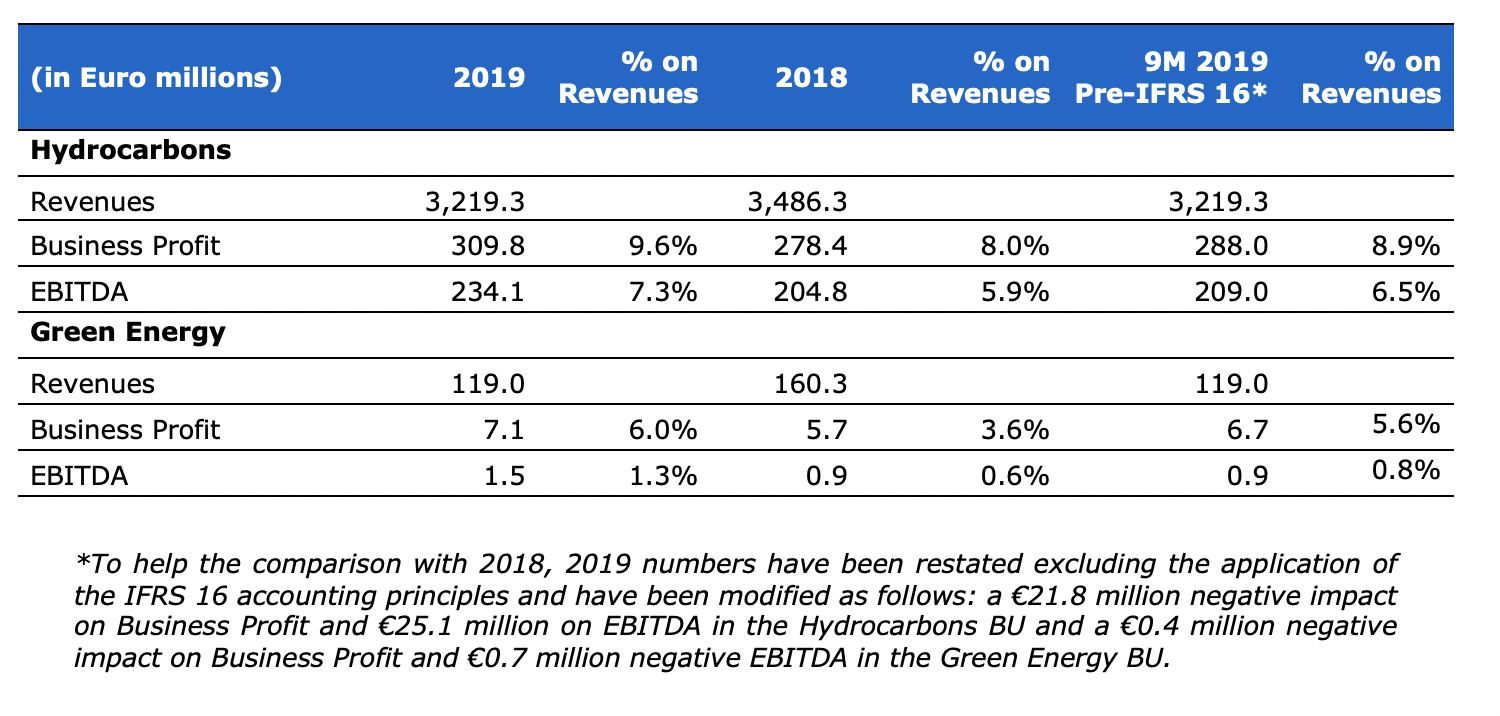

FINANCIAL HIGHLIGHTS BY BUSINESS UNIT

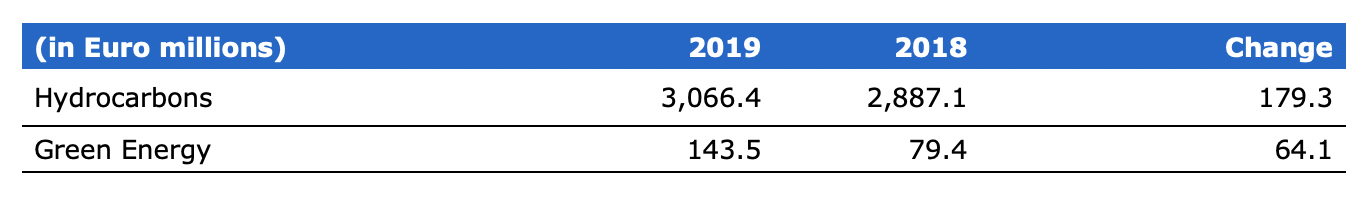

ORDER INTAKE BY BUSINESS UNIT

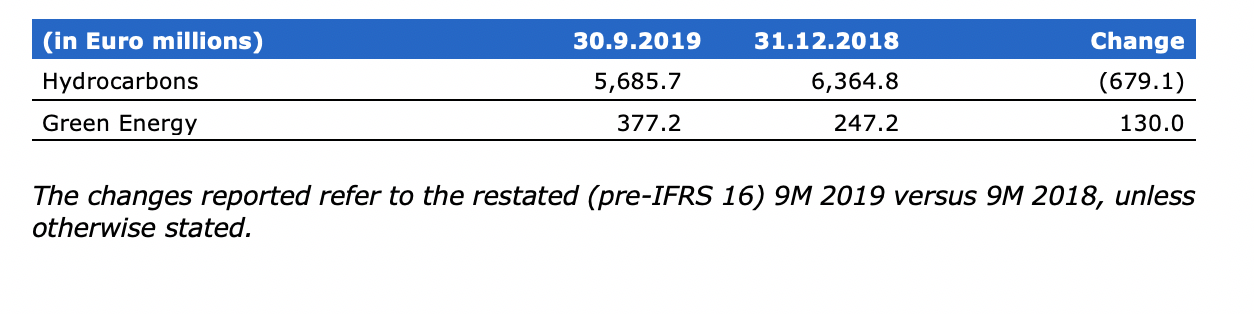

BACKLOG BY BUSINESS UNIT

Consolidated Financial Results as at 31 December 2019

Maire Tecnimont Group Revenues were €3,338.4 million, down 8.5%. Volumes reflect the non-linear progress of projects in the backlog, depending on the planned schedules for each project. In particular, in 2019, volumes reflect the final stages of the main EPC projects awarded over the past years, not yet compensated by new acquisitions that are still in their initial phases, and the temporary phasing of certain EPC projects in the third quarter. Volumes also reflect the type of contracts that were recently acquired, mainly Engineering, Procurement, Construction Management and Commissioning services, that generate lower volumes.

Restated Business Profit was €294.7 million, up 3.7%. The restated Business Margin was 8.8%, up versus 7.8%, as a result of the temporary change in the backlog mix.

Restated G&A costs were €78.1 million, or 2.3% of revenues, up compared to 2018, but substantially in line with the last quarters of 2019.

Restated EBITDA was €209.9 million, up 2.0%, due to a higher marginality in spite of lower volumes in 2019. The restated margin was 6.3%, up from 5.6%, for the same reasons detailed above.

Amortization, Depreciation, Write-downs and Provisions were €24.2 million, up 19.8%, mainly due to the amortization of new assets related to the Group's activities, the amortization of plants and machineries following the acquisition of MyReplast Industries by the subsidiary NextChem in 2019, the amortization of Contractual Costs, and the provisions on receivables related to old infrastructure initiatives.

Restated EBIT was €185.7 million, broadly in line with 2018 result. Margin increased from 5.1% to 5.6% .

Restated Net Financial Charges were €16.0 million, down by €3.2 million. The 2019 data includes an amount of €5.8 million related to a write off of a Convertible Bond issued by an affiliated company, Siluria Technologies, Inc.

Restated Pre-tax Income was €169.6 million, down 1.8%. Estimated taxes of €52.8 million have been provisioned.

The effective tax rate was approx. 31.1%, down compared to 32.0% and in line with the average normalized tax rate of the last few quarters, taking into account the various jurisdictions where Group operations have been carried out.

Restated Consolidated Net Income was €116.8 million, substantially unchanged. Restated Group Net Income was €115.1 million, up 4.1%.

Net Cash (net of the above-mentioned value in the table footnote) at December 31, 2019 was €78.9 million, down compared to €93.8 million of at 31 December 2018. The 2019 amount benefits from a €231.1 million cash inflow in the second half of the year, driven by an improvement in the Net Working Capital. The operating cash flows have also been impacted by a 2018 dividend payment of €39.1 million and cash taxes equal to €52.9 million.

Consolidated Shareholders’ Equity was €448.9 million, up €106.3 million vs. December 31, 2018. This increase was driven by the income for the period, and to a positive change of the derivatives’ Cash Flow Hedge reserve related to the positive mark to market of the derivatives hedging the projects’ flows, net of the fiscal effect and of the translation of the financial statements reported in a foreign currency, and taking into account a 2018 dividend payment of €39.1 million, and to the negative change in the Valuation Reserves related to the fair value valuation of certain financial assets.

Performance by Business Unit

Hydrocarbons BU

Revenues were €3,219.3 million, down 7.7%, due to the same reasons commented above. Restated Business Profit was €288.0 million, up 3.5%, leading to a restated Business Margin of 8.9%, up vs. 8.0%. Restated EBITDA was €209.0 million, with a margin of 6.5%, up vs. 5.9%.

Green Energy BU

Revenues were €119.0 million, down 25.7%, due to the end of a few contracts for large-scale plants in the renewable energy sector, not yet replaced by new acquisitions, and also to the final phase of a project in the hospital sector. At the same time, our subsidiary NextChem, active in the Circular Economy and the energy transition, started its operations after its first investment in an advanced mechanical plastic recycling plant. Restated Business Profit was €6.7 million, up 17.2%. The restated Business Margin was 5.6% vs. 3.6%. Restated EBITDA was €0.9 million, in line with the previous year.

Order Intake and Backlog

Thanks to €3,209.9 million of new orders generated in 2019, the Group’s Backlog at December 31, 2019 was €6,373.0 million. In particular, the main projects awarded to the Group include the following:

• a reimbursable EP contract for Exxon Mobil for the implementation of new innovative process units in Baytown petrochemical complex in the US

• an EPC contract awarded by a subsidiary of ENI to realize the upgrading of the Luanda refinery in Angola

• an EPC project from ANWIL, for the implementation of a new granulation unit in Poland to produce various types of fertilizers

• a licensing, Process Design Package (PDP) and Proprietary Equipment supply for a Urea plant for ShchekinoAzot in Russia

• an EPC contract awarded from INA-Industrija Nafte for the realization of a new Delayed Coking Complex for the Rijeka Refinery in Croatia;

• an agreement for the preliminary execution of engineering services and the subsequent execution of an EPC project with EuroChem, for a new fertilizer plant in Kingisepp, Russia.

Subsequent Events

• On January 29, 2020, Maire Tecnimont confirms its position (“B”) in the ranking of Carbon Disclosure Project the international not-for-profit organization that researches the impact of listed companies in terms of climate change policies and performance.

• On February 10, 2020, NextChem announced a cooperation agreement with US-based Saola Energy to license in the international markets a technology for the production of Renewable Diesel (Hydrotreated Vegetable Oil, or HVO in short) from vegetable oils and residual fats.

• On March 11, 2020, Maire Tecnimont announced the acquisition of new contracts for a total of €220 million, in its core business, mainly in Europe.

Outlook

The Group continues to maintain a high backlog at the end of 2019. Thanks also to the contracts under finalization over the next few months, the Group will experience a good industrial performance in the following quarters.

Thanks to a flexible organizational model and to processes that have been structured to operate on a multi-local basis, at the moment projects’ execution continues in line with the schedules agreed with the clients. The same applies to the commercial activity in the various geographical areas where the Group has identified key projects. This notwithstanding the measures that have been adopted nationally and internationally in order to fight the effects caused by the so called CoronaVirus.

In spite of the uncertainties related to the impacts of this virus, and the consequences on the price of oil and its derivative products, the market environment is expected to favor investments in the downstream sector, in particular in plants that transform oil and gas into petrochemicals, and in the revamping of existing refineries in order to adapt the type and quality of their final products to the new market requirements, which are strongly influenced by recent environmental laws.

As for the Green Acceleration project, the Group continues to grow through its subsidiary NextChem, also following the investment made in 2019 in the most efficient and advanced plastic mechanical recycling plant in Europe. The plant is located in Italy and has already become a reference plant with an industrial scale size to support expected important domestic and international market opportunities. The recent agreements concerning the production of Renewable Diesel and of Hydrogen and Methanol from urban waste, are positioning NextChem to the center of the energy transition process, which has become a key characteristics of current markets. .

Proposal regarding the allocation of 2019 profit and distribution of dividends

The Board of Directors, in today's meeting, decided to propose to the Ordinary Shareholders' Meeting to allocate the entire profit for the year of €30,727,467.52 and the use of retained earnings of €7,394,822.59, for a total amount of €38,122.290.11, to be allocated to shareholders through the payment of a dividend of €0.116, gross of withholding tax, for each of the 328,640,432 ordinary shares, with no par value, existing to date and entitled to the dividend, with coupon detachement (coupon no. 6) on 20 April 2020 (so-called “ex date”) and payment from 22 April 2020 (so-called “payment date”).

Pursuant to art. 83 terdecies of Legislative Decree no. 58 of 24 February 1998 ("TUF") shareholders are entitled to a dividend paid through an intermediary, as per art. 83 quater, paragraph 3, of the TUF, at the end of the accounting day of 21 April 2020 (so-called “record date”). The total dividend proposed is one third of the consolidated net profit at 31 December 2019. The Board of Directors believes that this proportion allows for the recognition of adequate remuneration for shareholders and also allows for the continuation of the capital strengthening process, which is essential to operate competitively on international markets. .

***

Webcast Conference Call

The 2019 financial results will be presented today at 5:30pm CET during an audio-webcast conference call held by the top management.

The conference call may be followed as a webcast by connecting to the website (www.mairetecnimont.com) and clicking on the “FY 2019 Financial Results” banner on the Home Page or through the following url:

https://87399.choruscall.eu/links/mairetecnimont200311.html

Alternatively, you may participate in the conference call by calling one of the following numbers:

Italy: +39 02 805-8811

UK: +44 121 281-8003

USA: +1 718 705-8794

The presentation given by the top management will be available at the start of the conference call in the “Investors/Results and Presentations/Financial Results” section of Maire Tecnimont’s website (https://www.mairetecnimont.com/en/investors/results-and-presentations/financial-results). The presentation shall also be made available on the 1info storage mechanism (www.1info.it).

***

Dario Michelangeli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Draft Statutory and the Group’s Consolidated Financial Statements as at December 31, 2019 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law. This press release, and the “Outlook” section in particular, contains forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including the continued volatility and further decline of the capital and finance markets, raw material price changes, altered economic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

Maire Tecnimont S.p.A.

Maire Tecnimont S.p.A., a company listed on the Milan Stock Exchange, is at the head of an international industrial group leader in the transformation of natural resources (plant engineering in downstream oil & gas, with technological and execution competences). Through its subsidiary NextChem it operates in the field of green chemistry and the technologies to support the energy transition. Maire Tecnimont Group operates in about 45 countries, numbering around 50 operative companies and a workforce of approximately 6,300 employees, along with approximately 3,000 professionals in the electro-instrumental division. For more information: www.mairetecnimont.com.

Institutional Relations and Communication

Carlo Nicolais, Ida Arjomand

public.affairs@mairetecnimont.it

Media Relations

Image Building

Alfredo Mele, Carlo Musa, Alessandro Beretta

Tel +39 02 89011300

mairetecnimont@imagebuilding.it

Investor Relations

Riccardo Guglielmetti

Tel +39 02 6313-7823

investor-relations@mairetecnimont.it