- Robust quarter with double-digit growth of main economic metrics

- o Revenues of €957.9 million (+31.5%)

- o EBITDA of €58.0 million (+32.7%) with a 6.1% margin

- o Net Income of €26.2 million (+46.8%)

- Excellent results achieved by the business unit Sustainable Technology Solutions, with revenues up 43.3% and EBITDA up 56.3%

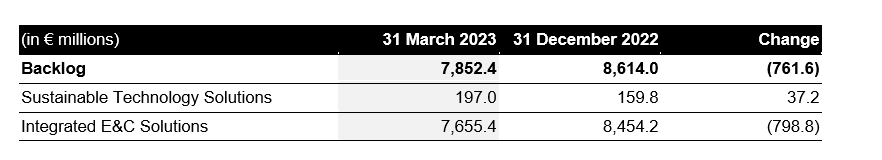

- Backlog of €7.9 billion provides good visibility going forward

- Commercial Pipeline of €54.1 billion

- Successfully completed the acquisitions of Conser and MyRemono, owner of CatC technology, expanding the portfolio of sustainable technologies to foster future growth

- Net Cash Position of €94.6 million, net of €35.8 million purchase price for Conser

- Distributed dividends for a total of €40.7 million, paid on 26 April 2023

- Guidance for 2023 confirmed

Milan, 3 May 2023 – The Board of Directors of Maire Tecnimont S.p.A. (“MAIRE” or the “Company”) met today to review and approve the Group’s Interim Financial Report as of 31 March 2023.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented:

“The first quarter results approved today confirm the soundness of our business model which, leveraging on sustainable technologies combined with our extensive experience in executing complex projects, places Energy Transition at the core of Maire’s industrial strategy. Economic figures reported a double-digit growth and cash flow from operations more than compensated investments, which were mainly dedicated to the expansion of our technology portfolio to foster future growth. On the back of a €7.9 billion backlog and a strong set of commercial opportunities to be exploited, we look to the rest of 2023 with confidence.”

CONSOLIDATED FINANCIAL RESULTS AS OF 31 MARCH 2023

Revenues were €957.9 million, up 31.5% year-over-year, thanks to the progression of projects towards phases which can generate higher volumes.

Operating costs, amounting to €899.9 million, were up 31.4% year-over-year, in line with revenues.

EBITDA was €58.0 million, up 32.7% thanks to higher revenues and the efficient management of structural costs. EBITDA Margin was 6.1%, increasing 10 basis points year-over-year.

Amortization, Depreciation, Write-downs, and Provisions were €12.1 million, slightly higher due to the start into operation of new assets for the digitalization of industrial processes, new patents and technological developments.

EBIT was €45.9 million, up 43.9% year-over-year, with a margin of 4.8%, 40 basis points higher year-over-year.

Net Financial Charges were €8.4 million, compared to €6.3 million in the same period of 2022. The figure for the first quarter 2023 was affected by the variation in the mark-to-market of derivative instruments which was negative for €0.9 million, vis-à-vis a positive valuation of €0.4 million in the same period of 2022, therefore resulting in a negative change of €1.3 million. Financial charges, net of the aforementioned effects, slightly increased year-over-year due to the impact of the increase in interest rates on the floating-rate portion of debt, compensated by a higher financial income.

Pre-tax Income was €37.5 million and the tax provision was €11.3 million. The effective tax rate was 30.1%, in line with the last quarters, mainly due to the various jurisdictions where Group operations have been carried out.

Consolidated Net Income was €26.2 million, up 46.8% year-over-year due to the facts mentioned above. Group Net Income was €25.2 million, up 37.1% year-over-year.

Adjusted Net Cash as of 31 March 2023 (net of the above-mentioned values included in the footnote on page 1) was €94.6 million, increasing by €0.8 million versus the end of December 2022. The cash generation more than compensated the investments made in the period for a total value of €41.0 million, of which €35.8 million related to the acquisition of Conser S.r.l. (€19.2 million net of cash acquired), in line with the Group's strategy to expand its sustainable technology portfolio.

Consolidated Shareholders’ Equity was €561.0 million, up €32.9 million versus 31 December 2022.

PERFORMANCE BY BUSINESS UNIT

The Q1 2023 results by business unit reported below are consistent with the new organizational and reporting structure adopted by Group starting from financial year 2023, compared with the pro-forma figures as of 31 March 2022.

Revenues amounted to €56.5 million, up 43.3% thanks to the constant growth recorded in the solutions to support the energy transition and to the technological agreements signed with various Italian and international counterparties.

EBITDA was €11.8 million, up 56.3% thanks to higher volumes and a different mix of technological solutions, as well as to the contribution of the recent acquisitions.

Revenues amounted to €901.4 million,up30.8% thanks to the project progress towards phases able to generate higher volumes.

EBITDA amounted to €46.2 million, up27.8% for the reasons mentioned above and with a margin of 5.1%, substantially in line with the results of the first quarter of 2022.

Order intake in Q1 2023 was €302.9 million, of which €78.4 million related to Sustainable Technology Solutions, representing a seven-fold increase year-over-year. At Group level, over 52% of the order intake of the period was awarded in Europe and the Americas, increasing geographical diversification of the portfolio.

Main projects awarded to the business unit Sustainable Technology Solutions include a feasibility study by Foresight Group to decarbonize the ETA Manfredonia waste-to-energy plant in Italy and contracts related to licensing, process design package and equipment supply for an urea plant in China, which will represent the largest plant with Ultra-Low Energy proprietary design globally.

New awards related to the business unit Integrated E&C solutions include an early works contract related to the onshore facilities of the Hail & Ghasha project in the UAE to be executed as part of a consortium for a total value of $80 million, an EPC (Engineering, Procurement and Construction) contract for the realization of nine solar plants in Chile, a contract for the extension of engineering and construction works for a carbon capture plant at the natural gas plant of Casalborsetti, in the province of Ravenna (Italy), as well as change orders finalized with clients on various projects.

As a result of the Q1 2023 order intake, the Group's Backlog at 31 March 2023 amounted to €7,852.4 million.

SUBSEQUENT EVENTS AFTER THE CLOSE OF THE PERIOD

Closing of Conser S.r.l. acquisition

On 13 April 2023, MAIRE announced that NextChem Holding S.p.A., the subsidiary belonging to the Sustainable Technology Solutions business unit, finalized the acquisition of an 83.5% stake in Conser, a technology licensor and process engineering design company, expanding its technology portfolio in bio-degradable plastics, with an estimated contribution €13-15 million of operating margin expected in 2023. The accounting and tax effects of the transaction take effect as of 1 January 2023.

Maire Tecnimont S.p.A. Shareholders' Meeting

The Shareholders' Meeting of MAIRE held on 19 April 2023, among other items, approved the Financial Statements as at 31 December 2022 and the distribution of dividends for a total of €40.7 million paid on 26 April 2023, adopted certain resolutions on governance and remuneration matters, as well as authorized the purchase and disposal of treasury shares and certain amendments to the Company’s Articles of Association.

The Board of Directors of the Company was held on the same date and confirmed Alessandro Bernini as Chief Executive Officer.

New Advanced Basic Engineering Study awarded by Storengy

On 21 April 2023, MAIRE announced that its subsidiary NextChem, part of Sustainable Technology Solutions business unit, after completing the advanced methanation engineering study, already communicated in July 2022 for the Salamandre project in Normandy, has been awarded a new contract from Storengy to perform a further advanced engineering study for waste wood gasification and purification of the synthesis gas (syngas) system to produce biomethane.

Closing of CatC technology acquisition

On 27 April 2023, MAIRE announced that NextChem, the subsidiary belonging to the Sustainable Technology Solutions business unit, has completed the acquisition of 51% of MyRemono S.r.l., a new company in which Biorenova S.p.A. has transferred patents, assets, including a pilot plant, and contracts related to CatC, an innovative plastic chemical recycling technology, which the Group intends to scale up and industrialize. MyRemono’s revenues are expected to progressively grow starting from 2025 for a cumulated value of €30 million by 2028. After this ramp-up period, yearly revenues are expected to be in the €15-20 million range, with an EBITDA margin of approximately 40%.

OUTLOOK

The general market context is still impacted by the consequences of international geopolitical tensions, and, as such, it continues to remain critical and uncertain in relation to the overall raw materials price increases and their availability, transport logistics, and procurement in certain geographies, notwithstanding early signs of a gradual normalization, also following the monetary tightening measures undertaken by the main central banks worldwide in order to curb inflation.

In a scenario still characterized by high prices of natural resources, the willingness to invest in low carbon infrastructures for the transformation of natural resources has remained unchanged, thanks to a strong global demand for several commodities, also due to the lack of production originating in the countries impacted by the current conflict.

The above-mentioned drive to reduce the carbon footprint leads the Group to strengthen the integration between the traditional downstream technologies and a wide range of newly green tech solutions, both proprietary and otherwise available to subsidiaries belonging to the Sustainable Technology Solutions Business Unit.

2023 Guidance

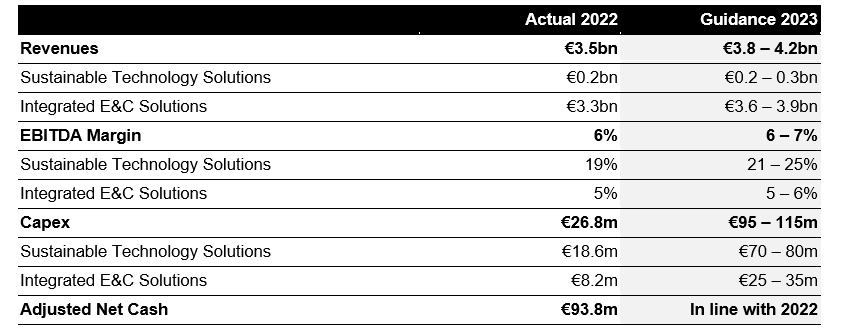

In light of the above, particularly the significant backlog, the Company confirms the guidance for 2023, disclosed with the 2023-32 Strategic Plan on 3 March 2023, which includes the following KPIs expected for the current year:

UPDATE ON THE EURO COMMERCIAL PAPER PROGRAMME

With reference to the Euro Commercial Paper program launched in 2022 by Maire Tecnimont S.p.A. for the issue of one or more non-convertible notes placed with selected institutional investors, with no rating, with a duration of three years and a maximum total value of the Notes issued and not redeemed equal to €150 million, it should be noted that as at 31 March 2023 the program is used for an amount of €24.3 million. The expiries of the notes are in the months of April, June and September 2023, and in the months of January and February 2024.

The weighted average interest rate on outstanding financial liabilities is approximately 3.765%; during 2023, notes were issued for a total of €41.2 million and repaid for €19.4 million.

CONFERENCE CALL AND WEBCAST

The top management of Maire will present Q1 2023 Financial Results during a conference call today at 5:30pm CEST.

Dial-in details:

Italy: +39 02 362-13011

UK: +44 1 212 818-003

USA: +1 718 705-8794

The event will be webcast simultaneously and can be accessed at:

https://87399.choruscall.eu/links/mairetecnimont230427.html

The presentation will be available at the start of the conference call in the “Investors/ Financial Results” section of Maire’s website (https://www.mairetecnimont.com/en/investors/financial-results/). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Fabio Fritelli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as of 31 March 2023 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.mairetecnimont.com (in the “Investors/Results and Presentations/Financial Results” section, and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable.

This press release, and the “Outlook” section in particular, include forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

***