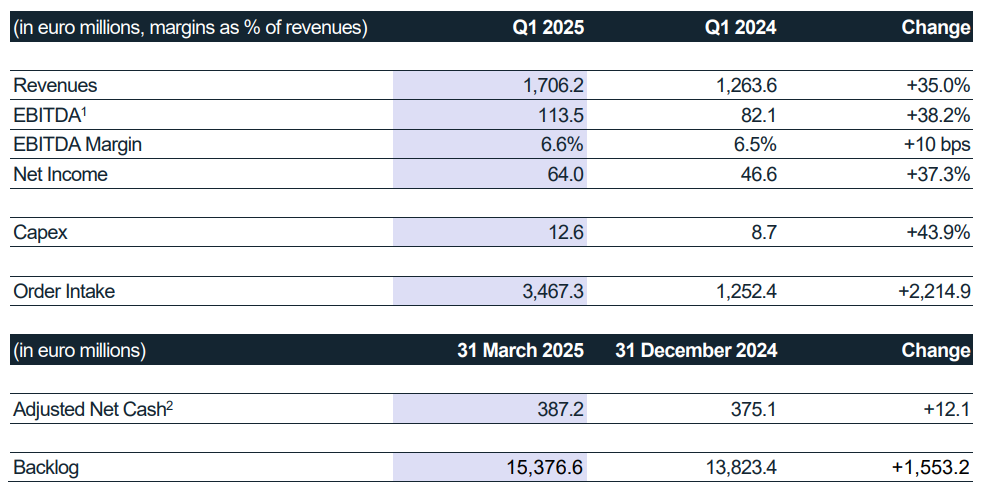

- Double-digit growth of the main economic metrics compared to Q1 2024:

- Revenues of €1.7 billion (+35.0%)

- EBITDA of €113.5 million (+38.2%) with a margin increase from 6.5% to 6.6%

- Net income of €64.0 million (+37.3%)

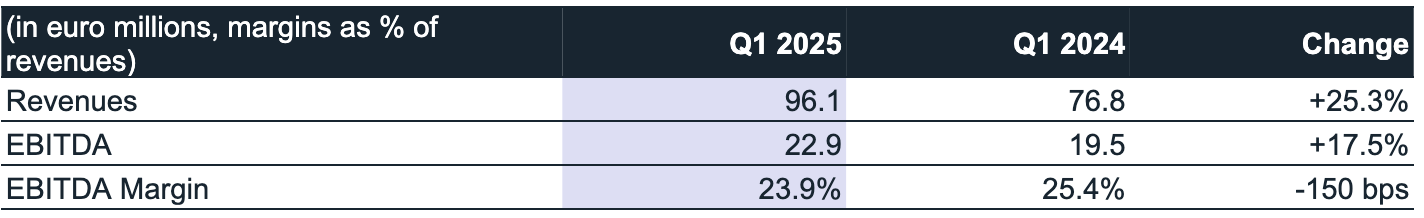

- NEXTCHEM grows in line with expectations: generating revenues of €96.1 million (+25.3%) and EBITDA of €22.9 million (+17.5%), with a margin of 23.9%

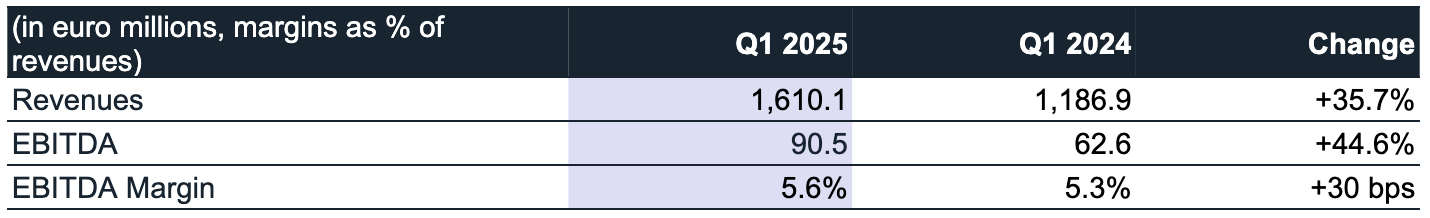

- Remarkable performance of Integrated E&C Solutions: generating revenues of €1.6 billion (+35.7%) and EBITDA of €90.5 million (+44.6%), with a margin increase from 5.3% to 5.6%

- Adjusted net cash position of €387.2 million, up €12.1 million compared to the end of 2024, net of €12.6 million of capex and €32.1 million of buy-back program

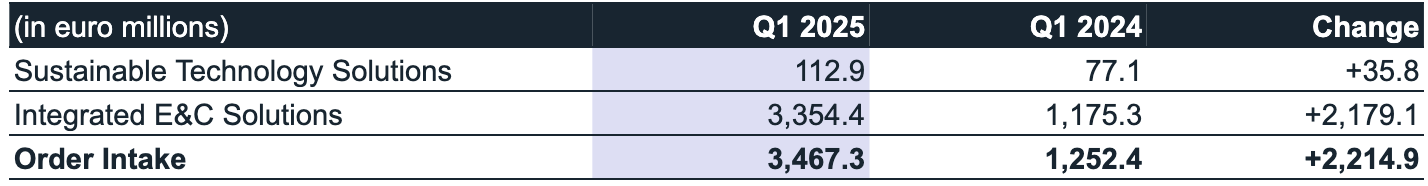

- First quarter order intake of €3.5 billion, leading to a backlog of €15.4 billion, up €1.6 billion compared to the end of 2024

- New awards and additional works of previously announced orders for a total of €900 million in the month of April

- Reached a headcount of 10,000 people, with an increase of over 220 professionals compared to the end of 2024, mainly to support execution capability

- Dividend of €114.5 million distributed in April, equal to €0.356 per share, up 81% compared to the previous year

- 2025 guidance confirmed

Milan, 29 April 2025 – The Board of Directors of MAIRE S.p.A. (“MAIRE” or the “Company”) met today to review and approve the Group’s Interim Financial Report as of 31 March 2025.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented: “We are proud to deliver the first quarter 2025 financial results with a double-digit growth in both revenues and margins – a testament to the soundness of our strategy and the commitment of our people. Our solid backlog, exceeding 15 billion euro at the end of March, has been strengthened by further 900 million euro of contracts awarded in April, as we continue to diversify our geographical footprint and enhance our revenue visibility in the medium term. The growing role of the Global South and the expected resilience of the downstream energy investment cycle give us confidence to navigate today’s complex macroeconomic scenario.”

HIGHLIGHTS

Consolidated financial results as of 31 March 2025

Revenues were €1.7 billion, up 35.0%, thanks to the consistent progress of projects under execution.

EBITDA was €113.5 million, up 38.2%, driven by higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.6%, up 10 basis points, also thanks to the contribution from higher value-added services.

Amortization, Depreciation, Write-downs, and Provisions were €15.5 million, substantially in line.

EBIT was €98.0 million, up 46.6%, with a margin of 5.7%, up 40 basis points.

Net financial charges were €4.6 million, compared to €0.3 million of net financial income in the first quarter of 2024, a result which had benefitted from a positive variation of the mark-to-market of derivative instruments.

Pre-tax Income was €93.4 million and the tax provision was €29.4 million. The effective tax rate was 31.5%, in line with the past quarters, taking into account the different geographies in which the Group’s activities are carried out.

Net Income was €64.0 million, up 37.3%, with a 3.8% margin, up 10 basis points.

Adjusted Net Cash2 as of 31 March 2025 was €387.2 million, up by €12.1 million compared to 31 December 2024. Operating cash generation more than compensated the share buy-back program of €32.1 million and capital expenditures of €12.6 million, which were mainly dedicated to the enhancement of the technology portfolio and to digital innovation projects.

Consolidated Shareholders’ Equity was €688.2 million, up €47.1 million compared to 31 December 2024, positively impacted by the profit of the period, net of the share buyback, taking also into account the impact of exchange rate fluctuations.

Performance by business unit

SUSTAINABLE TECHNOLOGY SOLUTIONS (STS)

Revenues were €96.1 million, up 25.3%, thanks to the contribution of technological solutions and services mainly for the production of nitrogen fertilizers, carbon capture, and low-carbon and circular fuels.

EBITDA was €22.9 million, up 17.5%, thanks to higher volumes, with a margin of 23.9% driven by a different product mix.

INTEGRATED E&C SOLUTIONS (IE&CS)

Revenues were €1.6 billion, up 35.7%, thanks to the steady execution of projects, including the Hail and Ghasha gas treatment and sulphur recovery plant in Abu Dhabi, the other main contracts in the Middle East, as well as the increasing contribution of projects acquired in Algeria last year.

EBITDA was €90.5 million, up 44.6%, with a margin of 5.6%, up 30 basis points, benefitting also from a higher operating leverage.

Order Intake and Backlog

ORDER INTAKE

Order Intake in the first quarter 2025 was €3.5 billion.

In particular, the Sustainable Technology Solutions business unit, led by NEXTCHEM, generated new orders for €112.9 million. The main projects awarded in the first quarter include:

- a licensing contract by Pengerang Biorefinery for a hydrogen production unit in Malaysia, based on the proprietary NX Reform™ technology;

- a process design package to upgrade a fertilizer plant in China based on the proprietary NX Stami Urea™ technology;

- a licensing contract by Transition Industries for a ultra-low carbon methanol plant in Mexico, based on the proprietary NX AdWinMethanol® Zero technology;

- a contract for high value-added engineering services for a waste-to-chemical project in Southern Europe;

- a proprietary equipment contract for a project aimed at producing low-carbon fuelsin Sub-Saharan Africa;

- a three-year contract by SATORP to provide engineering and technology services for the Sulphur Recovery Complex at Jubail refinery, in Saudi Arabia.

The Integrated E&C Solutions business unit generated new orders for €3.4 billion. The main projects awarded in the first quarter include:

- an EPCC contract by Pengerang Biorefinery for a hydrogen production unit in Malaysia;

- two EPC contracts awarded by major international clients for petrochemical and upgrade of existing plants in Central Asia and Sub-Saharan Africa.

BACKLOG

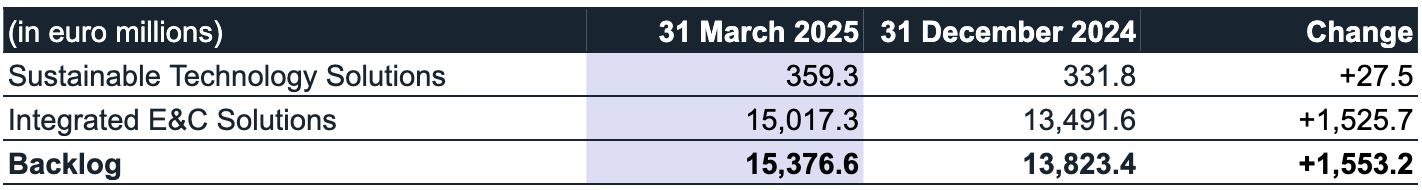

As a result of the order intake of the period, the Group's Backlog at 31 March 2025 amounted to €15.4 billion, up €1.6 billion compared to the end of 2024.

Update on the Hail and Ghasha project

The Hail and Ghasha gas treatment and sulphur recovery project, awarded to Tecnimont in October 2023 for USD8.7 billion, is progressing as planned, with completion expected in 2028. As of the end of March 2025, the project team has reached almost ten million safe man-hours, and the overall progress is around 25%. Engineering work is on track, with some tasks ahead of schedule. Procurement is progressing well, along with manufacturing activities. Construction is advancing, and all sub-contracts have been awarded, mostly to local companies, in line with the Group’s In-Country Value targets.

SIGNIFICANT EVENTS AFTER THE CLOSE OF THE PERIOD

Ordinary Shareholders’ Meeting

The Ordinary Shareholders’ Meeting of MAIRE held on 14 April 2025, among other items, approved the Financial Statements as of 31 December 2024 and the distribution of a dividend of €0.356 per share, up 81% compared to last year, with payment date 24 April 2025. Taking into account the treasury shares held in portfolio by MAIRE as of 23 April 2025 (so-called record date), the total dividend amount is equal to €114,462,516.59. Additionally, the Shareholders’ Meeting appointed the new corporate bodies, adopted certain resolutions on governance and remuneration matters, as well as authorized the purchase and disposal of treasury shares and amended the economic terms of the legal audit assignment granted to the outgoing audit firm PricewaterhouseCoopers S.p.A., with reference to the 2023 financial year. The Shareholders’ Meetings also granted the assignment of certifying the compliance of the sustainability reporting of the MAIRE S.p.A. Group for the financial years 2025-2027 to the audit firm Deloitte & Touche S.p.A.

Completion of the treasury share buy-back program

On 28 April 2025, MAIRE announced it completed the share buy-back program dedicated to the employee incentive plans launched on 5 March 2025. Under the program, the Company purchased no. 7,700,000 shares at a weighted average price of €8.23 per share, for a total amount of €63.3 million.

Contracts awarded in April

On 29 April 2025, TECNIMONT and KT-Kinetics Technology – also thanks to the technological and engineering services provided by NEXTCHEM – have been granted additional works of previously announced orders and new awards for a total amount of approximately €900 million for engineering, procurement and construction activities related to petrochemical infrastructures and high-value added engineering services for green hydrogen facilities in Central Asia and Southern Europe.

Outlook

Amid a complex geopolitical and macroeconomic environment, the Group benefits from a solid backlog, further strengthened and diversified by the recent awards, and composed by projects not directly impacted by the current global trade tensions. At the same time, the demand for innovative technological solutions and, more in general, the downstream segment, are characterised by robust and resilient fundamentals, suitable to bring commercial opportunities that may materialize into new contracts in the coming months, in line with the expectations of €8 billion of order intake for FY 2025.

2025 guidance

In the first quarter of the year, the Group delivered a stronger-than-expected operating performance, particularly regarding projects under execution in the Middle East.

The planned activities of the projects in the backlog, including the recent acquisitions, as well as those expected to be acquired over the course of the year, are expected to lead to a steady revenue growth and margin expansion especially in the second half of the year for the STS business unit, and therefore to a potential upward revision of the Group’s 2025 expected performance.

However, considering the persistent conditions of uncertainty and volatility in international markets, at this stage, the Board of Directors has resolved to confirm the economic-financial guidance communicated to the market on 4 March 2025, during the presentation of the Strategic Plan 2025-2034.

Any potential revision of estimates will be communicated with the release of the results for the first half of the year.

Update on the organic growth of the group

To support the Group’s growth, MAIRE continues to invest in acquiring new talent. Headcount reached around 9,966 employees as of 31 March 2025, an increase of 227 professionals compared to 31 December 2024.

***

Conference Call and Webcast

The top management of MAIRE will present the Q1 2025 Results during a conference call today at 5:30pm CEST.

The live stream of the event can be accessed at the following link:

MAIRE Q1 2025 Results Conference Call

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 06 83360400

UK: +44 (0) 33 0551 0200

USA: +1 786 697 3501

The presentation will be available at the start of the event in the “Investors/Financial Results” (Financial Results | Maire) section of MAIRE’s website (groupmaire.com). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Mariano Avanzi, as Executive for Financial Reporting with, also, responsibility for certification as per paragraph 5-ter regarding Sustainability reporting - declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as of 31 March 2025 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.groupmaire.com in the “Investors/Financial Results” section (Financial Results | Maire), and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable.

This press release includes forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.