Upon receiving his “Honoris Causa” degree in Chemical Engineering in the spring of 2018, he was visibly overcome with emotion. Crossing the threshold of the lecture hall named after Nobel Prize winner Giulio Natta, in the heart of the Milan Polytechnic Institute, Fabrizio Di Amato saw the ideal timeline of the entrepreneurial path that, as a young 19-year-old at the helm of a small company, led him to become president and main shareholder of the Maire Tecnimont Group. «I have always considered it important to go where other professionals did not: looking for new horizons and creating new niches in the market» Di Amato explains to us today, recalling the “Blue Ocean” theories and the great industrial development of Italian engineering.

The story of the number one at Maire Tecnimont is a personal one, full of entrepreneurial flair, intelligence and expertise that has been put to good use in a country that has benefited from a human capital of excellence, despite its limited amount of underground natural resources. «If I think back to my first few years, I remember starting out as an outsider in an industry dominated by long-established companies and consolidated business. My search was for uncharted territories that did not yet exist in the business world. But in the wake of the great changes that took place in the 90s, we realized that new areas of the market were opening up».

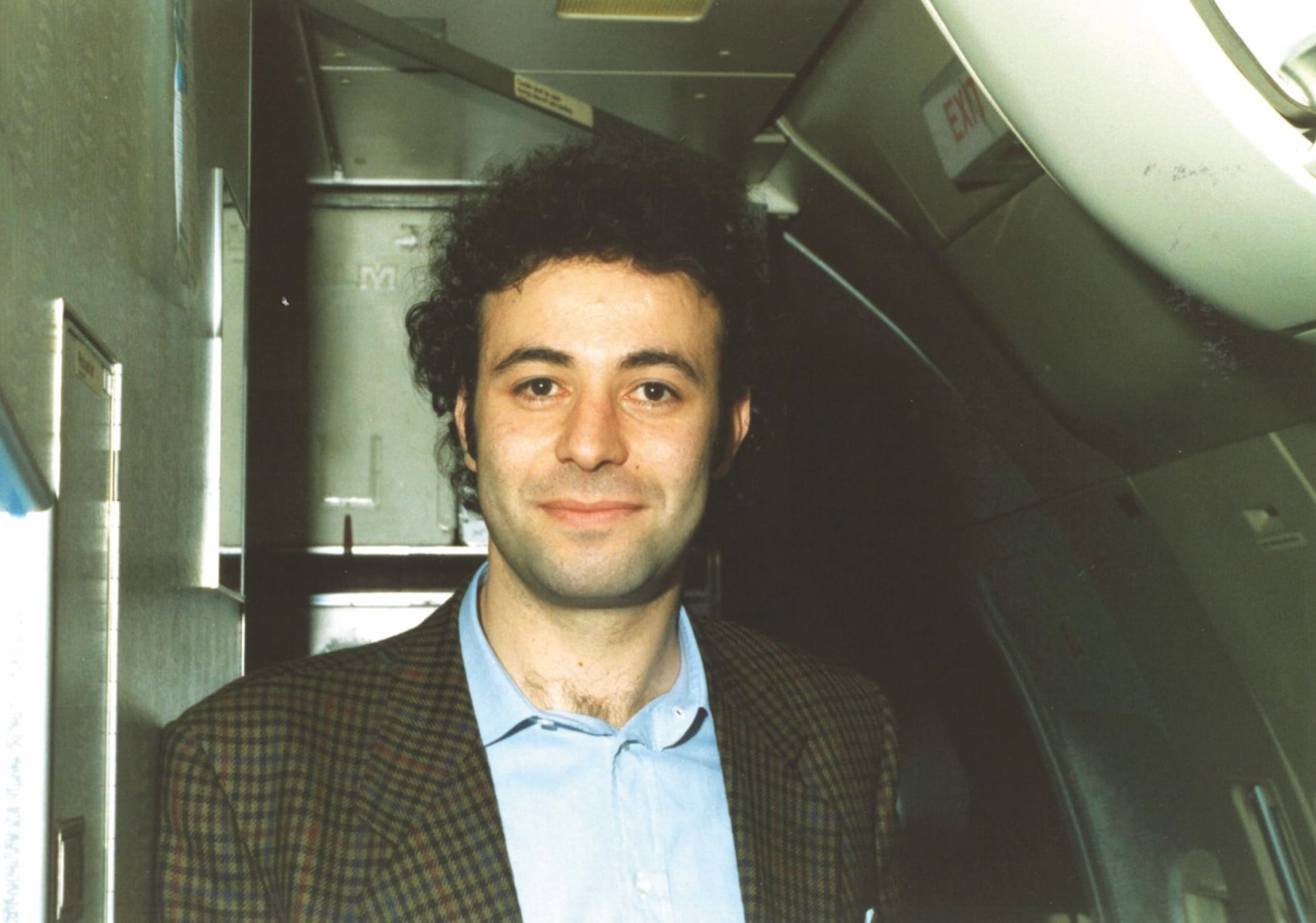

AT THE AGE OF 19 HE STARTED WITH 3 EMPLOYEES, TODAY HE IS AT THE TOP OF A GROUP OF 50 COMPANIES IN 45 COUNTRIES AND OVER NINE THOUSAND EMPLOYEES. FABRIZIO DI AMATO IS THE EXAMPLE OF AN ENTREPRENEUR WHO INTERPRETS ENTREPRENEURSHIP AS TAKING ON RESPONSIBILITY AND SHARING GREAT CHALLENGES.

An overall vision looking ahead to the future

To analyze his entrepreneurial vision properly, we need to take a step back. Back to the time when, as a boy, Fabrizio Di Amato gathered some work experience in a small plant engineering company during the summer. «I was 17 years old – he says, smiling – and I helped in the office, on the construction site, and in supplier relations. I did a bit of everything, but I had an excellent predisposition for following economic and financial trends». Studying and working in the same company, Di Amato acquired many skills: at the age of eighteen the owner at that time asked him to lead a team of 20 employees. «It was a great school – he recalls – I was flattered by the offer, but it did not correspond with my intentions, because I had a different idea. I told him that I would be opening my own company, but if he wanted, I would work for him as a subcontractor. And that’s how it went. At the age of 19, I formed a de facto company, and from there my adventure began».

As Giuseppe Berta, professor of Contemporary History at Bocconi University, maintains (we will discuss his essay “L’enigma dell’imprenditore” in a separate article), entrepreneurship, which comes from the term “imprendere” meaning to take a risk, has often been characterized as the driving force behind the economic process. For this reason, the key value for every Maire Tecnimont employee today is entrepreneurship as an assumption of responsibility. In establishing the typical features of great entrepreneurs – their behavior as well as their values – business historians summarize three ideal characteristics: the “engineer”, the “businessman”, and the “financier”. Linked to the same number of spheres of economic action: the job market, the product market and the financial market.

Acquisitions and meritocracy

Supported by a sense of entrepreneurship lived as a vocation and destiny, since 1983 Fabrizio Di Amato has always reinvested everything, acquiring small companies in search of expertise. «If you want to grow – he explains – you must always be focused on your goals, have a clear direction to follow and at the same time seek the best among those skills, both technological and human, that you need most to develop. Those that you do not have available internally, you must know how to bring in from the outside. As I did when we started expanding our technology portfolio: you have to start by identifying technologies that are adjacent to your business. And the same is true when you bring people into your company: you must always convey clear objectives, lay out a path, but do so from a perspective of meritocracy. We need to run slowly, moving forward while guaranteeing long term stability».

By the arrival of 2000, Di Amato (whose company, in the meantime, already had about 20 million in revenue and 400 employees) chose to change his strategy, deciding to focus on large engineering and contracting firms. The acquisitions of first Fiat Engineering and then Tecnimont demonstrate the objective of bringing together the enormous unexpressed potential and international profile of these companies, in a sector that risked being taken over by foreign investors (with inevitable reductions in employment and the loss of both expertise and associated activities). «Integrating Fiat Engineering and Tecnimont was a real injection of confidence and entrepreneurial energy, to the benefit of organizations unaccustomed to competition. By transforming them into companies capable of competing in the market, we paved the way to building a group of excellence capable of operating abroad and, as a general contractor, of managing increasingly important and complex projects all over the world, developing an increasingly technology-driven approach. Before I landed on Fiat Engineering, I scouted many Italian companies in the general contracting sector. But I always ran into the same problem: most of the time the financial situation of the companies from the construction sector was precarious, while those from the engineering sector showed a more solid performance and were more international. When the Fiat crisis began to manifest itself, those activities less related to Fiat’s core business of automobiles, which included Fiat Engineering, were put on the market. It seemed to me to be the right opportunity, but it was not easy. It was even difficult to get a meeting in Turin. I still remember that when I introduced myself, I found a group of Fiat managers sitting around a table. The one who was at the head of the table looked at me and said: Before you sit down, do you have the money...? Fiat Engineering was much bigger than us: its revenue was over fifteen times greater than ours. The negotiation was very tough, and in the end, we agreed on 30% initial Fiat participation with the commitment that after three years they would be completely out. Ultimately, things went better than planned, and in light of the following acquisition, we completed the transaction after just one year. It was the most difficult transaction I’ve ever made. And also, very brave. Having always kept the plant engineering activity separate from other personal business endeavors, I had the opportunity to contribute to this important acquisition thanks to proceeds from divestments and other income. Going from 200 people to 1,000 was not an easy feat. But we succeeded».

After Fiat Engineering, the arrival of Tecnimont

The acquisition of Tecnimont, once an engineering division of the Montedison Group, was the second important step in the Group’s growth. The company was active in the construction of large industrial plants all over the world, especially in the petrochemical sector. It was heir to the great Italian tradition of industrial chemistry that dates back to Giulio Natta, the inventor of polypropylene.

«My goal was to internationalize: Tecnimont, thanks to the great competence of its people and its presence in many countries, was the ideal platform that had to remain Italian. This was also a very complex acquisition, evaluated as one of the most important m&a operations in Italy. Today Tecnimont is a world leader in the execution of polyolefin plants with a global market share of 30%. At the same time, it has expanded its business to refining, to the entire gas value chain and progressively to the energy transition and green chemistry. In the acquisition process there was no colonization of the buyer over the company that was bought out, but rather an enhancement of the distinctive internal skills according to a merit system. A method that I have always adopted in all acquisitions. By betting on the right people».

To obtain Tecnimont, Fabrizio Di Amato and his team had to defeat the competition of a major Japanese company. «The Confindustria of those times, led by Luca Cordero di Montezemolo, also played an important role. On the other hand, the risk was that the country would lose first-rate engineering skills, and I wanted to get to where we are now, among the first in plant engineering for the transformation of hydrocarbons. After Tecnimont I tried to make contact with Eni to acquire Snamprogetti: but after an initial approach their strategy changed and they decided not to sell».

The fact that Di Amato developed all three characteristics of the entrepreneur is a fundamental factor in his case, especially the financial aspect, which succeeded in establishing a strong nucleus of technical and commercial know-how. Di Amato confirms: «What was one important step? I met some enlightened bankers who, without knowing me personally, assessed and appreciated this industrial project to create a major international engineering player, and the fact that I was contributing with my own capital to the transaction as well as my commitment as a long-term shareholder. The natural resources transformation sector where Maire Tecnimont operates is for the most part comprised of public companies, and people outside of Italy are not used to seeing an entrepreneurial figure behind it all. But when they come to realize, it becomes a further guarantee. I had developed a good relationship with the banks due to the creditworthiness I had acquired over the years. They knew that I paid regularly, as I had demonstrated throughout my entire entrepreneurial history. In fact, I have always believed in the financial solidity of holding companies which I believe must be well capitalized with their own resources, so that, if necessary, they are able to intervene in support of the operating companies, as I needed to do in 2013».

By endowing the Group with entrepreneurial tenacity (necessary to keep the rudder straight), a willingness to look beyond limitations and the ability to integrate insight and skill, in 2013 Fabrizio Di Amato completed its management reorganization process with the hiring of a CEO. «I know many entrepreneurs who were fundamental to the starting of their company, but who are now struggling to let go of their operational power. When we were small, I did everything myself, but the more the company grows, the more the complexities increase. We chose the right moment to delegate our operational leadership to a CEO, Pierroberto Folgiero, whom I consult with daily, and who can count on many capable managers all contributing to operational management. I believe that the entrepreneur, regardless of the delegated powers, must make his presence felt, supporting management in their strategies through a very short decision-making chain».

The background of Maire Tecnimont's name

The rest is recent and ongoing history. After the acquisitions of Fiat Engineering and Tecnimont – leading up to the creation of the Maire Tecnimont Group in 2005 – followed the acquisitions of the remaining 50% of Tecnimont ICB India in 2008 (headquartered in Mumbai, now the main engineering center abroad with over 5,000 employees and technicians) and Stamicarbon, a Dutch company and global leader in the development of technologies for the production of urea (fertilizers), with intellectual property and over 50% of the global market in terms of licensing in 2009. «The following year – recalls the chairman – we finalized the acquisition of KT-Kinetics Technology, a well-known Roman company active in hydrogen and sulfur technologies and the construction of plants. KT also allowed us to expand our expertise in refining, contributing to the development of our new technologies in the green chemistry sector, as is the case with the much talked about hydrogen».

Why the name Maire Tecnimont? «At the time of the creation of the parent company, which integrated the first two large companies acquired, a new name had to be chosen. We even hired a specialized company but we didn’t like any of their proposals. In the end, Maire came to mind, which I had already used, and which is the acronym of the names of my two eldest children: Massimo and Irene. The name of my other holding company, Glv, is derived from the names of my youngest children: Giovanni, Ludovico and Vittoria».

Looking ahead in order to meet global environmental challenges and achieve European decarbonization targets, new chemistry will increasingly focus on waste recycling, biochemistry and electrochemistry. The latest to be created was NextChem in November of 2018, a subsidiary where the managerial and technological expertise of the Group’s other companies involved in Green Chemistry have converged. Fabrizio Di Amato concludes: «We were pioneers in this transformation. Today NextChem is a solid entity, with numerous projects underway to accompany the energy transition. It is an irreversible process, but also a great opportunity to reposition Italy, re-launch employment and create long-term industrial value».

The enigma of the entrepreneur