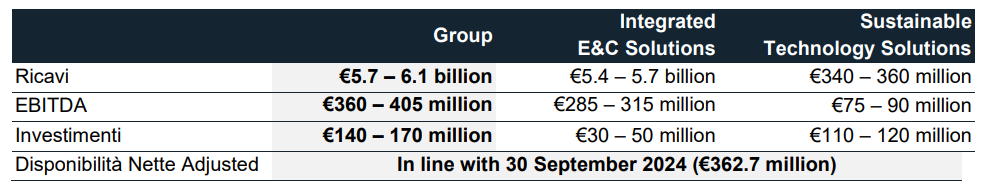

Milan, 28 October 2024 – In relation to certain contents published in the media on 24 and 25 October 2024, MAIRE S.p.A. (“MAIRE” or the “Company”) recalls that the Board of Directors on 24 October 2024, on the occasion of the approval of the financial results as of 30 September 2024, confirmed, as already communicated to the market on the same date, the 2024 Guidance, which includes the following expected KPIs for the current year:

In particular, the Company recalls that revenues are expected to accelerate, with a consolidated amount expected to be at least €1.8 billion in the fourth quarter of the year, entirely driven by the planned progress of projects already in the portfolio, with a significant contribution from the Hail and Ghasha project. The EBITDA margin is expected in line with the nine-month figure, amounting to 6.5%, while Adjusted Net Cash is expected in line with the figure as of 30 September 2024, amounting to €362.7 million.

It should also be noted that the envisaged €6 billion acquisitions of new projects are in addition to the €3.7 billion recorded as of 30 September 2024. Part of these new orders are expected by the end of this year, in line with the envisaged yearly order intake of approximately €6 billion, while the remaining part is expected to be finalized at the beginning of 2025. The finalization of these new contracts does not affect the achievement of the 2024 fiscal year guidance.

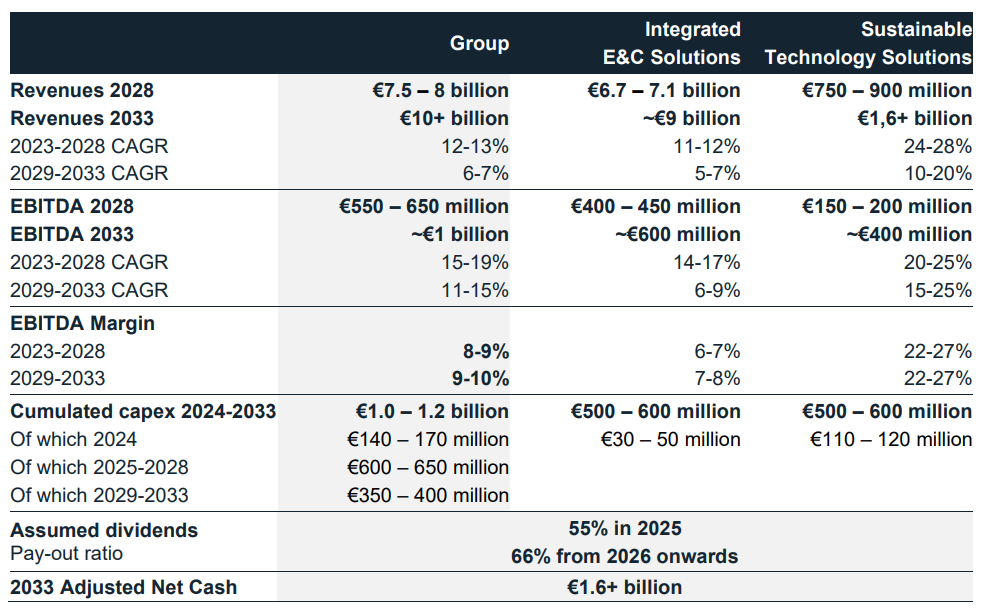

It is also recalled that the 2024 Guidance represents the first year of the 2024-2033 strategic plan approved by the Board of Directors on 5 March 2024, and already presented to the market on the same date, with the following financial targets:

The presentation to analysts, already made available on 24 October 2024, will consequently be integrated, among other things, with the clarifications contained in this press release and made available to the public in the “Investors/Financial Results” section of MAIRE’s website (Financial Results | Maire (groupmaire.com)). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).