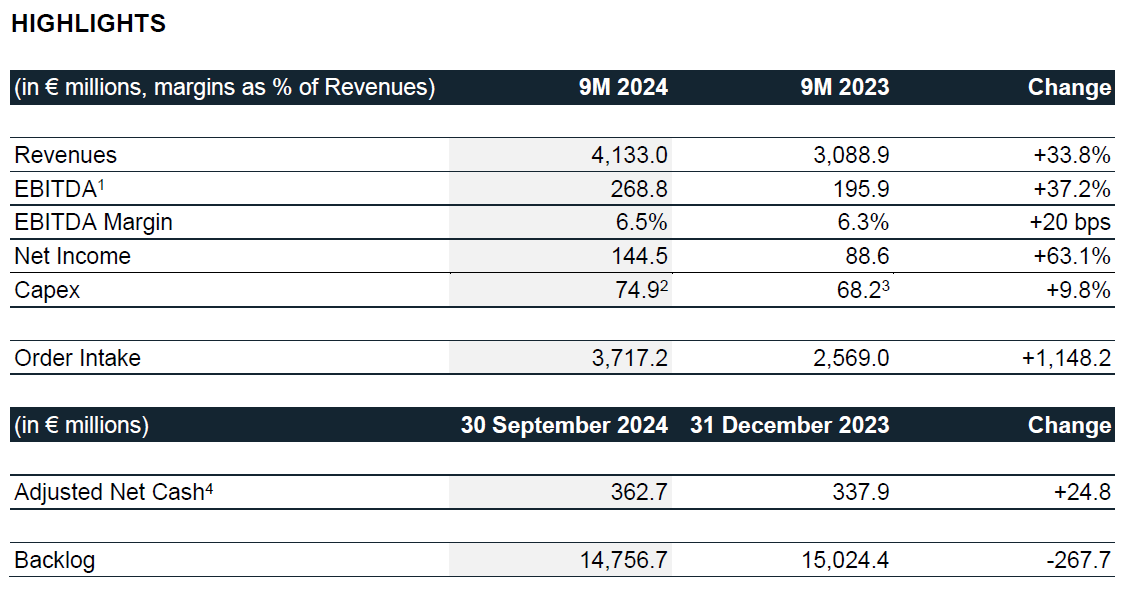

- The nine-month period recorded double-digit growth in the key economic metrics:

- Revenues exceeding €4.1 billion (+33.8%)

- EBITDA of €268.8 million (+37.2%), margin increased from 6.3% to 6.5%

- Net income of €144.5 million (+63.1%), margin increased from 2.9% to 3.5%

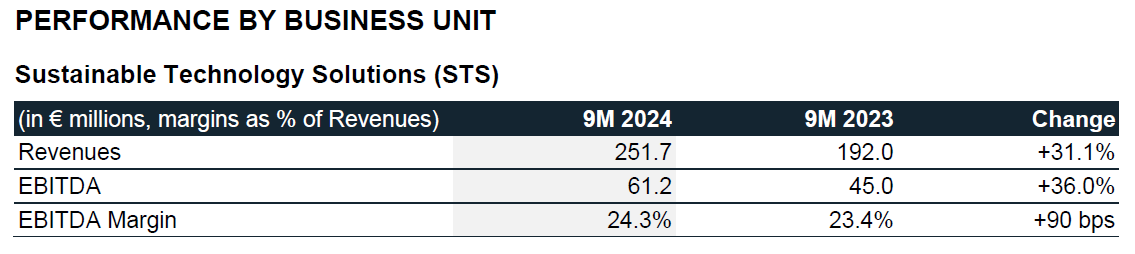

- Outstanding performance of Sustainable Technology Solutions, generating revenues of €251.7 million (+31.1%) and EBITDA of €61.2 million (+36.0%)

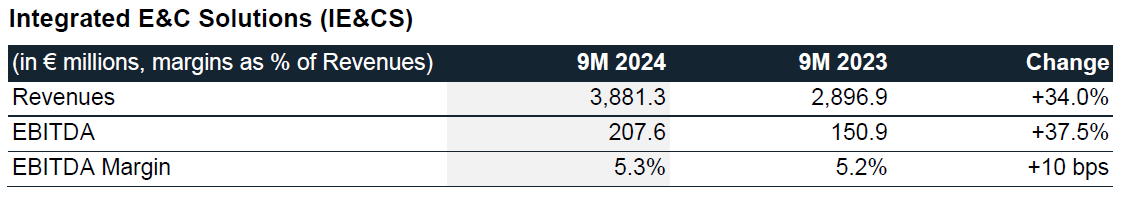

- Steady expansion of Integrated E&C Solutions, generating revenues of €3.9 billion (+34.0%) and EBITDA of €207.6 million (+37.5%), with Hail and Ghasha advancing on schedule

- Adjusted Net Cash of €362.7 million, up €24.8 million compared to the end of 2023

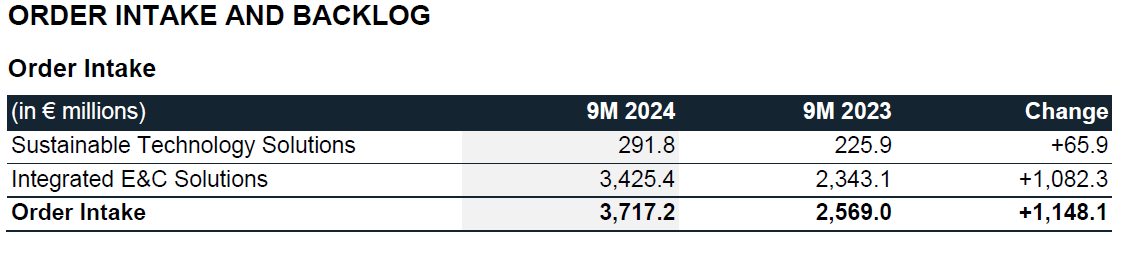

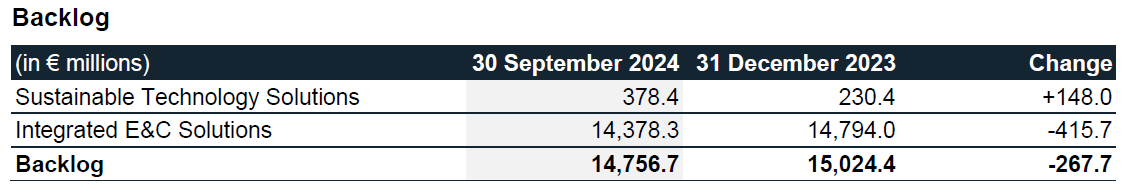

- Order intake at €3.7 billion, leading to a backlog of €14.8 billion

- Engineering capacity enhanced by hiring activities and the acquisition of APS Group, bringing the headcount to over 9,300 people

- 2024 Guidance confirmed

- Advancing NEXTCHEM through new organization built on three business lines: Sustainable Fertilizers, Low Carbon Energy Vectors, and Circular Solutions. Fabio Fritelli named NEXTCHEM CEO, who therefore resigns as manager responsible while keeping the position of group Chief Financial Officer

- Mariano Avanzi appointed as Manager responsible for preparing MAIRE's financial reports, in addition to taking on certification responsibilities regarding sustainability reporting

Milan, 24 October 2024 – The Board of Directors of MAIRE S.p.A. (“MAIRE” or the “Company”) today reviewed and approved the Nine-Month Consolidated Financial Report as of 30 September 2024.

Alessandro Bernini, Chief Executive Officer of MAIRE, commented: “We are pleased to present our nine-month results for 2024, which reflect consistent double-digit growth in key metrics and increased profitability. Today, we unveiled the new organization of Sustainable Technology Solutions, led by NEXTCHEM, which is at the forefront of delivering innovative, scalable solutions to meet the urgent global demand for sustainable energy and industrial practices. We remain committed to delivering impactful, economically viable solutions for our clients and the communities we serve. Meanwhile, in Integrated E&C Solutions, we continue to capitalize on the energy investment cycle by expanding our engineering capacity. Our headcount surpassed 9,300 by the end of September, and the recent acquisition of APS Group has further strengthened our multidisciplinary teams. Our €14.8 billion backlog and strong growth visibility underscore the success of our strategic initiatives.”

[1] EBITDA is net income for the year before taxes (current and deferred), net financial expenses, gains and losses on the valuation of holdings, amortization and depreciation and provisions.

2 Including the purchase price at nominal value for the acquisitions of HyDEP and Dragoni Group (for a total €5.1 million of which €3.8 million paid upfront), GasConTec (€30.2 million of which €5.2 million paid upfront) and APS Group (€7.7million of which €1.2 million paid upfront), as well as for the additional 34% stakes in the subsidiaries MyReplast Industries and MyReplast (for a total €8.9 million of which €5.1 million paid upfront).

3 Including the upfront purchase price for the acquisition of an 83.5% stake in Conser SpA (€35.8 million) and a 51% stake in MyRemono Srl (€6.9 million), not deducting the total cash acquired (€17.6 million).

4 Excluding leasing liabilities – IFRS 16 (€134.2 million as of 30 September 2024 and €129.1 million as of 31 December 2023) and other minor items.

CONSOLIDATED FINANCIAL RESULTS AS OF 30 SEPTEMBER 2024[1]

Revenues were €4.1 billion, up 33.8%, thanks to the consistent progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €268.8 million, up 37.2%, driven by higher revenues and the efficient management of overhead costs. EBITDA Margin was 6.5%, up 20 basis points, also thanks to the contribution from high value-added services and technologies.

Amortization, Depreciation, Write-downs, and Provisions were €45.3 million, up €6.2 million due to the marketing of new patents and technological developments, as well as the start into operation of assets for the digitalization of industrial processes.

EBIT was €223.4 million, up 42.5%, with a margin of 5.4%, up 30 basis points.

Net financial charges were €7.7 million, down €21.9 million, thanks to the positive contribution of derivative instruments and a higher yield on cash deposits.

Pre-tax Income was €215.7 million and the tax provision was €71.2 million. The effective tax rate was 33.0%, slightly up compared with the last periods, mainly due to the various jurisdictions where Group operations have been carried out.

Net Income was €144.5 million, up 63.1%, with a 3.5% margin, up 60 basis points.

Adjusted Net Cash as of 30 September 2024, excluding leasing liabilities (IFRS 16) and other minor items, was €362.7 million, up by €24.8 million versus 31 December 2023. Operating cash generation more than compensated the outflows for capital expenditures of €33.8 million, dividends of €63.5 million, and the share buy-back program of €47.3 million.

Total Capex, which were mainly dedicated to the expansion of the technology portfolio and the engineering capacity, as well as to digital innovation projects, were €74.9 million. The amount includes also the deferred and earn-out components of the acquisition prices of HyDEP and Dragoni Group, GasConTec, APS Group (which includes APS Evolution, APS Designing Energy and KTI Poland) as well as for the additional stakes in MyReplast and MyReplast Industries.

Consolidated Shareholders’ Equity was €605.6 million, up €25.9 million versus 31 December 2023, thanks to profit of the period, partially offset by the FY2023 dividend payment, the share buy-back program and the impact of exchange rate fluctuations.

[1] The changes reported refer to 9M 2024 versus 9M 2023, unless otherwise stated.

Revenues amounted to €251.7 million, up 31.1%, thanks to the constant growth recorded in technological solutions and services mainly in nitrogen fertilizers, carbon capture and circular fuels.

EBITDA was €61.2 million, up 36.0%, as a result of higher volumes, with a margin of 24.3%, up 90 basis points, also thanks to the product mix.

Revenues amounted to €3.9 billion, up 34.0%, thanks to the progress of projects under execution, including the engineering and procurement activities of Hail and Ghasha.

EBITDA was €207.6 million, up 37.5%, and with a margin of 5.3%, up 10 basis points.

Order Intake in the nine months of 2024 was €3.7 billion.

In particular, the Sustainable Technology Solutions business unit led by NEXTCHEM generated new orders for €291.8 million. The main projects awarded in the third quarter to this business unit include:

- licensing and process design package awarded by Linggu Chemical to improve the energy efficiency of a urea plant in China with proprietary Advanced MP Flash Urea technology;

- a feasibility study based on the proprietary technology for maleic anhydride production in North America;

- licensing, engineering services, proprietary equipment and catalyst supply awarded by Sarlux to integrate NX CPO™ technology in a SAF pilot plant at Sarroch’s facility (in Sardinia, Italy);

- a feasibility study with PT Tripatra Engineers and Constructors for a SAF project in Indonesia based on proprietary NX PTU™ and NX SAF™ BIO technologies;

- two process design packages and licensing awarded by SOCAR to upgrade the HAOR complex in Azerbaijan, leveraging on proprietary NX Sulphurec™ technology;

- licensing and process design package based on Ultra-Low Energy proprietary technology for El Delta urea plant expansion in Egypt;

- licensing, process design package and catalyst supply awarded by Al Baleed Petrochemical Company and based on the proprietary maleic anhydride technology for a plant in Oman.

The Integrated E&C Solutions business unit generated new orders for €3.4 billion. The main projects awarded in the third quarter to this business unit comprise change orders and several engineering services contracts, including an engineering design study awarded by Sembcorp Green Hydrogen for a green ammonia plant in India.

For the details on the awards of the first quarters of 2024, please refer to the corresponding Financial Results press releases.

As a result of the order intake of the period, the Group's Backlog at 30 September 2024 amounted to €14.8 billion.

UPDATE ON THE HAIL AND GHASHA PROJECT

The Hail and Ghasha gas treatment and sulphur recovery project, awarded to Tecnimont in October 2023 for a value of $8.7 billion, is progressing on schedule, which envisages completion in 2028. At the end of September 2024, the project team has achieved one million safe man-hours. Engineering activities progressed with the completion of the 30% milestone for 3D modelling, while over 95% of equipment purchasing activities have been carried out. Finally, the construction activities, which started ahead of schedule, focused on the foundation works for the process area

SUBSEQUENT EVENTS AFTER THE CLOSE OF THE PERIOD

Signing of new €200 million Sustainability-linked revolving credit facility

On 17 October 2024, MAIRE announced the signing of a new sustainability-linked revolving credit facility maturing in May 2028, with a total amount of €200 million. The applicable margin is based on the achievement of specific annual targets aimed at reducing the Group’s CO2 emissions, in compliance with the Sustainability-Linked Financing Framework adopted in September 2023.

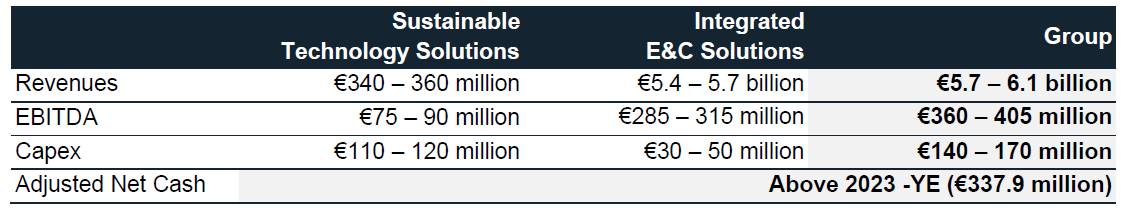

2024GUIDANCE

In light of the above, the Company confirms the 2024 guidance disclosed to the market with the 2024-2033 Strategic Plan on 5 March 2024, which includes the following expected KPIs for the current year:

In particular, revenues are expected to accelerate in the fourth quarter of this year, supported by the planned progress of projects awarded in 2023, mainly driven by the greater contribution from Hail and Ghasha, and from the activities related to projects acquired in the first part of this year.

EBITDA margin is expected in line with the nine-month trend, while Adjusted Net Cash is expected in line with the end of September.

ADVANCING NEXTCHEM: THE NEW ORGANIZATION UNVEILED

Advancing NEXTCHEM represents the next chapter of the strategic path aimed at developing and enhancing the Sustainable Technology Solutions business unit headed by NEXTCHEM which has adopted a new organization featuring three business lines, designed to address energy transition challenges:

- Sustainable Fertilizers leverages global leadership in urea technologies to advance nitrogen-based solutions, encompassing fertilizers and ammonia as a versatile energy carrier, mainly aimed to promoting agricultural sustainability.

- Low Carbon Energy Vectors builds on NEXTCHEM’s expertise in hydrogen production and sulfur recovery, focusing on developing technologies to produce low-emissions clean fuels and chemicals, and that convert carbon into sustainable plastics. These innovations support decarbonization across key sectors such as aviation, shipping, and chemicals.

- Circular Solutions focuses on advancing circularity by providing technological solutions transforming waste into valuable chemical resources. With expertise in mechanical and chemical recycling, it aims to create sustainable pathways for material recovery and reuse.

Overall, this new structure will enhance operational efficiency, expand market reach, and accelerate the development of scalable and sustainable technologies.

In order to fully implement the new organizational structure, with the aim of ensuring increasingly effective and efficient management, as well as continuous growth of the Sustainable Technology Solutions business unit, on 22 October 2024 the Board of Directors of NEXTCHEM appointed Fabio Fritelli, as new Managing Director of the company.

As a consequence, Fabio Fritelli – who maintains the role of Group Chief Financial Officer of MAIRE – has submitted his resignation from the position of Manager responsible for preparing MAIRE's financial reports, effective as of today.

MARIANO AVANZI APPOINTED AS MANAGER RESPONSIBLE FOR THE PREPARATION OF THE FINANCIAL REPORTS OF MAIRE, WITH CERTIFICATION RESPONSIBILITIES REGARDING SUSTAINABILITY REPORTING

Effective today, the Board of Directors of MAIRE, having obtained the favorable opinion of the Board of Statutory Auditors and in compliance with the requirements set forth by the Company Bylaws, has appointed – until revoked – Mariano Avanzi, Group AFC and Sustainability Reporting Vice President, as the new Manager responsible for the preparation of the Financial Reports of MAIRE replacing Fabio Fritelli. In addition to the certification responsibilities under Article 154-bis, Paragraph 5-bis, of the Italian Consolidated Law on Finance regarding financial reporting, the Board of Directors confirmed that Mariano Avanzi will be also vested with the certification responsibilities under Article 154-bis, Paragraph 5-ter, regarding sustainability reporting.

UPDATE ON HEADCOUNT GROWTH OF THE GROUP

MAIRE continues to invest in acquiring new talents to support the Group’s growth. Headcount as of 30 September 2024 exceeded 9,300 employees, up by approximately 1,350 people during the first nine months of the year, also thanks to the acquisition of APS Group completed in July 2024.

UPDATE ON THE EURO COMMERCIAL PAPER PROGRAMME

With reference to the Euro Commercial Paper program launched in 2021 by MAIRE for the issuance of one or more non-convertible notes placed with selected institutional investors, it should be noted that as at 30 September 2024 the program is utilized for €150 million. The notes will expire in several tranches between October 2024 and September 2025. The weighted average interest rate is 4.98%.

***

CONFERENCE CALL AND WEBCAST

MAIRE’s top management will present the 9M 2024 Financial Results and the new organization of NEXTCHEM during a conference call today at 3:00pm CEST.

The live stream of the event can be accessed at the following link:

MAIRE 9M FINANCIAL RESULTS | ADVANCING NEXTCHEM (choruscall.com)

Alternatively, you may join by phone using one of the following numbers:

Italy: +39 02 8020911

UK: +44 1 212818004

USA: +1 718 7058796

The presentation will be available at the start of the event in the “Investors/Financial Results” section of MAIRE’s website (Financial Results | Maire (groupmaire.com)). The presentation shall also be made available on the “1info” storage mechanism (www.1info.it).

***

Fabio Fritelli, as Executive for Financial Reporting, declares - in accordance with paragraph 2, Article 154-bis of Legislative Decree No. 58/1998 (“Consolidated Finance Act”) - that the accounting information included in this press release corresponds to the underlying accounting records.

The Interim Financial Report as of 30 September 2024 will be available to the public at the registered office in Rome, at the operative office in Milan, on the Company’s website www.groupmaire.com (in the “Investors/Financial Results” section), and on the authorized storage device “1info” (www.1info.it), according to the timing allowed by law.

This document makes use of some alternative performance indicators. The management of the Company considers these indicators key parameters to monitor the Group’s economic and financial performance. As the represented indicators are not identified as accounting measurements according to IFRS standards, the Group calculation criteria may not be uniform with those adopted by other groups and, therefore, may not be comparable.

This press release includes forecasts. The declarations are based on current estimates and projections of the Group concerning future events and, by their nature, are subject to risk and uncertainty. Actual results may differ significantly than the estimates made in such declarations due to a wide range of factors, including altered macroeconomic conditions and growth trends and other changes in business conditions, in addition to other factors, the majority of which outside the control of the Group.

***

As of today, Fabio Fritelli holds no. 13,472 ordinary shares of MAIRE, of which no. 3,472 deriving from the Company's incentive plans, and no. 100 “Senior Unsecured Sustainability-Linked Notes Due 2028” issued by MAIRE.

As of today, Mariano Avanzi holds no. 1,812 ordinary shares of MAIRE, all deriving from the Company's incentive plans.

Mariano Avanzi's curriculum vitae is available on the Company's website, in the Governance/Governance Model/Supervisory Bodies/Manager Responsible for the preparation of financial reports (Supervisory Bodies | Maire).

***